Introducing Goodrich Petroleum, A Stock That Climbed 16% In The Last Year

It might be of some concern to shareholders to see the Goodrich Petroleum Corporation (NYSEMKT:GDP) share price down 11% in the last month. But looking back over the last year, the returns have actually been rather pleasing! After all, the share price is up a market-beating 16% in that time.

Check out our latest analysis for Goodrich Petroleum

Goodrich Petroleum isn’t a profitable company, so it is unlikely we’ll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn’t make profits, we’d generally expect to see good revenue growth. That’s because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Goodrich Petroleum grew its revenue by 49% last year. That’s stonking growth even when compared to other loss-making stocks. While the share price gain of 16% over twelve months is pretty tasty, you might argue it doesn’t fully reflect the strong revenue growth. So quite frankly it could be a good time to investigate Goodrich Petroleum in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we’re seeing here?

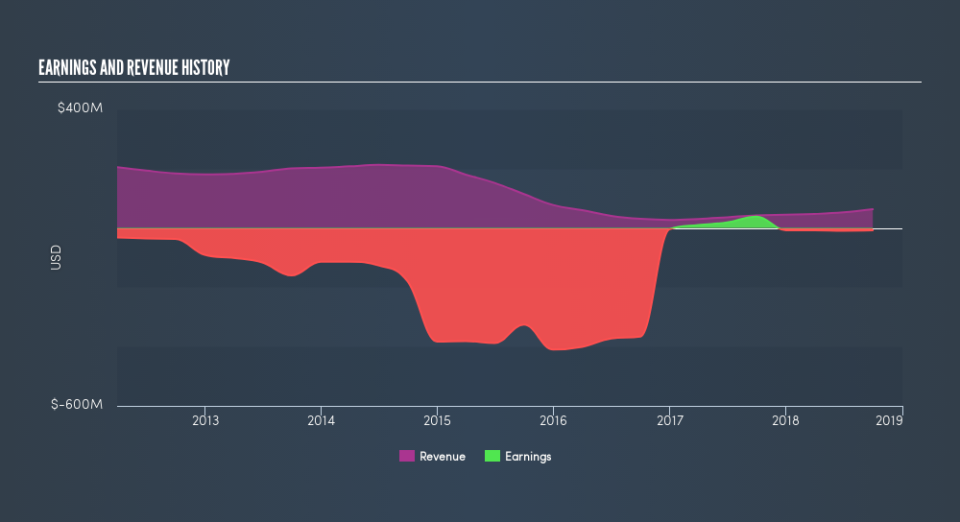

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Goodrich Petroleum boasts a total shareholder return of 16% for the last year. We regret to report that the share price is down 6.0% over ninety days. Shorter term share price moves often don’t signify much about the business itself. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Goodrich Petroleum may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.