Introducing Purple Innovation (NASDAQ:PRPL), The Stock That Zoomed 244% In The Last Year

It might be of some concern to shareholders to see the Purple Innovation, Inc. (NASDAQ:PRPL) share price down 13% in the last month. Despite this, the stock is a strong performer over the last year, no doubt about that. During that period, the share price soared a full 244%. So it is important to view the recent reduction in price through that lense. More important, going forward, is how the business itself is going.

Check out our latest analysis for Purple Innovation

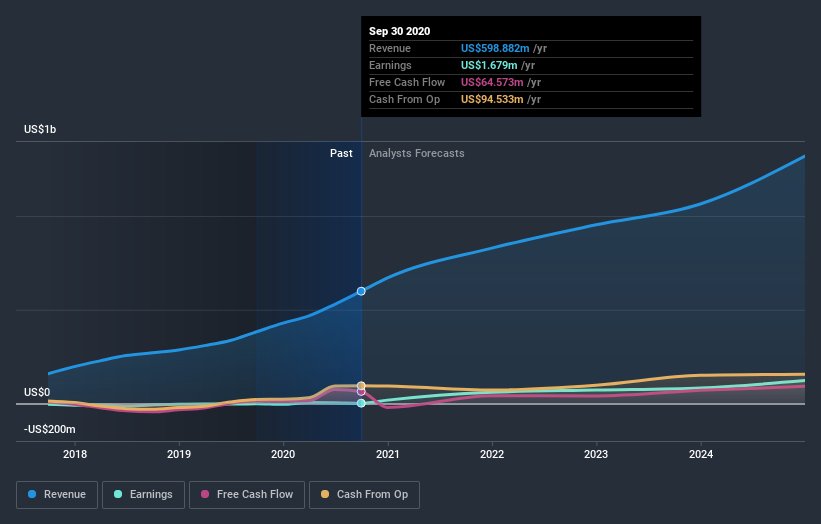

We don't think that Purple Innovation's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Purple Innovation grew its revenue by 56% last year. That's a head and shoulders above most loss-making companies. Meanwhile, the market has paid attention, sending the share price soaring 244% in response. It's great to see strong revenue growth, but the question is whether it can be sustained. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Purple Innovation will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Purple Innovation shareholders have gained 244% over the last year. That's better than the more recent three month gain of 31%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Purple Innovation has 4 warning signs we think you should be aware of.

Purple Innovation is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.