Invesco European Growth Fund's 1st-Quarter Buys

Earlier this week, the Invesco European Growth Fund (Trades, Portfolio) disclosed its portfolio updates for its reported first quarter of 2020, which ended on Jan. 31.

Invesco is a global financial services company with headquarters in Atlanta and offices in 25 countries around the world. The Invesco European Growth Fund (Trades, Portfolio) seeks long-term exposure to high-quality growth opportunities in both developed and emerging European markets.

As of the quarter's end, the equity portfolio consisted of positions in 56 stocks valued at $1.22 billion, with a turnover rate of 5%.

The fund's top equity positions were Sberbank of Russia PJSC (MIC:SBERP) at 6.01%, London-based marketing group DCC PLC (LSE:DCC) at 4.27% and Deutsche Boerse AG (XTER:DB1) at 3.18%. In terms of sector weighting, the fund was most heavily invested in industrials and financial services.

During the first quarter, the fund sold out of its holdings in Cie Financiere Richemont SA (XSWX:CFR) and Tecan Group Ltd (XSWX:TECN) and established new investments in Melrose Industries PLC (LSE:MRO), Knorr-Bremse AG (XTER:KBX) and Prosus NV (XAMS:PRX).

Prosus NV

The fund's biggest new buy of the quarter was for 263,294 shares of Prosus. The trade had a 1.55% impact on the equity portfolio. During the quarter, shares of the company traded at an average price of 64.97 euros ($71.24) apiece.

In mid-September of 2019, Prosus, a global internet investment company, spun off of its parent company Naspers (JSE:NPN), which maintained a 73% stake. Prosus is the largest consumer internet company in Europe and one of the biggest tech investors in the world.

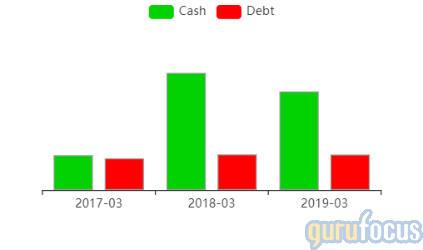

On April 1, shares of Prosus traded around 63.15 euros for a market cap of 102.66 billion euros and a price-earnings ratio of 19.7. GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 2 out of 10.

The cash-debt ratio of 2.51 and current ratio of 3.72 indicate that the company is able to meet its financial obligations in the short term, while the Altman Z-Score of 12.08 indicates high long-term financial strength.

However, the profitability rating is low largely because of how young the company is. Since it spun off in the third quarter of 2019, there is not yet sufficient data to calculate, for example, the revenue growth rate or the Ebitda growth rate as an independent company.

Knorr-Bremse AG

The fund also established a new position of 128,936 shares in Knorr-Bremse, impacting the equity portfolio by 1.15%. Shares traded around an average price of EUR90.63 throughout the quarter.

Knorr-Bremse is a century-old German company that manufactures brakes for rail and commercial vehicles. Its Rail Vehicle Systems division provides long distance mass transit trains with advanced braking systems, intelligent entrance systems and other components, while its Commercial Vehicles Systems division specializes in electronic brakes and air supply.

On April 1, shars of Knorr-Bremse traded around 76.17 euros per share for a market cap of 12.85 billion euros and a price-earnings ratio of 22.92. GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 5 out of 10.

Knorr-Bremse has a cash-debt ratio of 0.62, a current ratio of 1.58 and an Altman Z-Score of 3.62, indicating short-term and long-term financial stability. However, the cash-debt ratio has reached a 12-month low.

The operating margin of 14.92% and return on capital of 42.52% are good for the industry. Revenue has grown slightly since the company became publicly traded, though net income has remained around the same.

Melrose Industries PLC

The fund invested in 3,194,161 shares of Melrose Industries, which had a 0.81% impact on the equity portfolio. During the quarter, shares traded at an average price of 2.33 pounds sterling ($2.88).

London-based Melrose Industries buys and improves struggling businesses. Specifically, it buys good manufacturing businesses with strong fundamentals in which it sees areas where Melrose can help make improvements. Its businesses are mainly in the aerospace, automotive and powder metallurgy industries.

On April 1, shares of Melrose traded around 0.92 pounds for a market cap of 4.45 billion pounds. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10.

The cash-debt ratio of 0.08 is on the low end of the spectrum, as is the current ratio of 1.13. Combined with the Altman Z-Score of 1.04, the company may be in danger of going bankrupt within the next two years, although the company has pulled through with a lower Altman Z-Score in the past.

In terms of profitability, the operating margin of 2.55% is lower than 71.03% of industry competitors. Revenue has risen strongly over the past few years, though net income has been in the negatives since 2016, indicating that the current valuation could be attractive if the company pulls through and improves its margins.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research or consult registered investment advisors before taking action in the stock market.

Read more here:

5 Food Delivery Stocks Seeing Increasing Sales During Covid-19 Crisis

Buying What the Fed Buys

Video: Top Guru Stocks Proving Resilience to Downturns

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.