Investors Who Bought Corporación América Airports (NYSE:CAAP) Shares A Year Ago Are Now Down 46%

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Corporación América Airports S.A. (NYSE:CAAP) have tasted that bitter downside in the last year, as the share price dropped 46%. That's well bellow the market return of 8.1%. Corporación América Airports may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 46% in the last 90 days.

See our latest analysis for Corporación América Airports

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Corporación América Airports managed to increase earnings per share from a loss to a profit, over the last 12 months.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action. So it makes sense to check out some other factors.

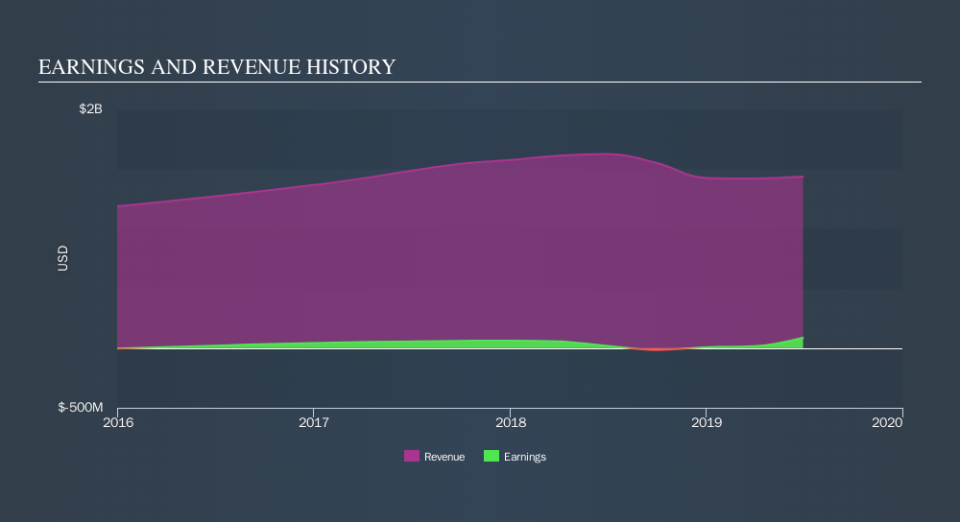

In contrast, the 12% drop in revenue is a real concern. If the market sees the weak revenue as jeopardising EPS, that could explain the lower share price.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Corporación América Airports has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Corporación América Airports will earn in the future (free profit forecasts).

A Different Perspective

Given that the market gained 8.1% in the last year, Corporación América Airports shareholders might be miffed that they lost 46%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 46% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Before deciding if you like the current share price, check how Corporación América Airports scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.