Investors Who Bought FFBW (NASDAQ:FFBW) Shares A Year Ago Are Now Down 11%

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the FFBW, Inc. (NASDAQ:FFBW) share price slid 11% over twelve months. That's well bellow the market return of 4.8%. FFBW hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time.

See our latest analysis for FFBW

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

FFBW stole the show with its EPS rocketing, in the last year. We don't think the growth guide to the sustainable growth rate in this case, but we do think this sort of increase is impressive. So we are surprised the share price is down. So it's worth taking a look at some other metrics.

FFBW managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

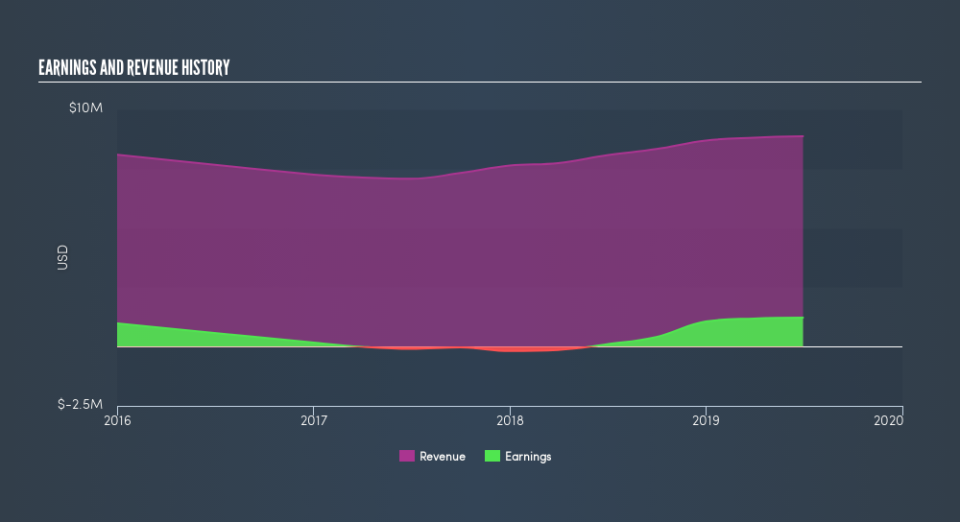

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at FFBW's financial health with this free report on its balance sheet.

A Different Perspective

Given that the market gained 4.8% in the last year, FFBW shareholders might be miffed that they lost 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 5.8%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like FFBW better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.