Investors Who Bought Funding Circle Holdings (LON:FCH) Shares A Year Ago Are Now Up 108%

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Funding Circle Holdings plc (LON:FCH) share price has soared 108% in the last year. Most would be very happy with that, especially in just one year! On top of that, the share price is up 14% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 7.5% in 90 days). Funding Circle Holdings hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Funding Circle Holdings

Because Funding Circle Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Funding Circle Holdings saw its revenue shrink by 38%. So we would not have expected the share price to rise 108%. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

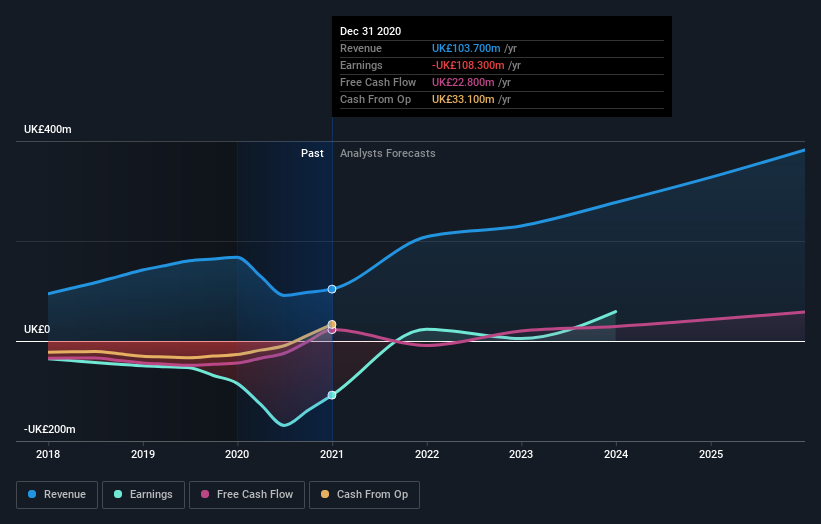

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for Funding Circle Holdings in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Funding Circle Holdings shareholders have gained 108% over the last year. The more recent returns haven't been as impressive as the longer term returns, coming in at just 14%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Funding Circle Holdings has 1 warning sign we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.