Investors Who Bought KBS Fashion Group (NASDAQ:KBSF) Shares Five Years Ago Are Now Down 98%

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held KBS Fashion Group Limited (NASDAQ:KBSF) for five whole years - as the share price tanked 98%. And some of the more recent buyers are probably worried, too, with the stock falling 51% in the last year. The falls have accelerated recently, with the share price down 19% in the last three months.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for KBS Fashion Group

KBS Fashion Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

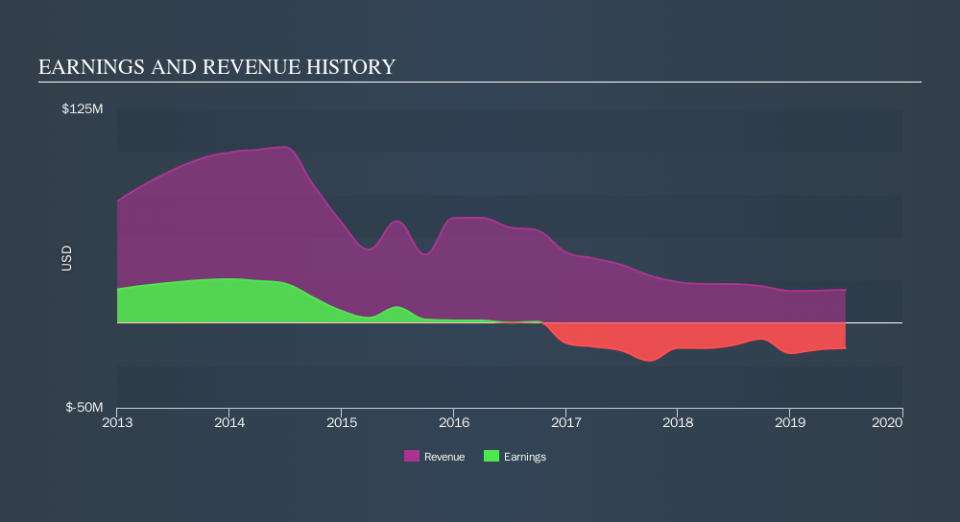

In the last five years KBS Fashion Group saw its revenue shrink by 30% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 53% per year in that period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on KBS Fashion Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

KBS Fashion Group shareholders are down 51% for the year, but the market itself is up 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 53% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like KBS Fashion Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.