Investors Who Bought Provident Bancorp (NASDAQ:PVBC) Shares Three Years Ago Are Now Up 49%

Provident Bancorp, Inc. (NASDAQ:PVBC) shareholders have seen the share price descend 11% over the month. But that doesn't change the fact that the returns over the last three years have been respectable. After all, the stock has performed better than the market (41%) over that time, over which it gained 49%.

See our latest analysis for Provident Bancorp

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

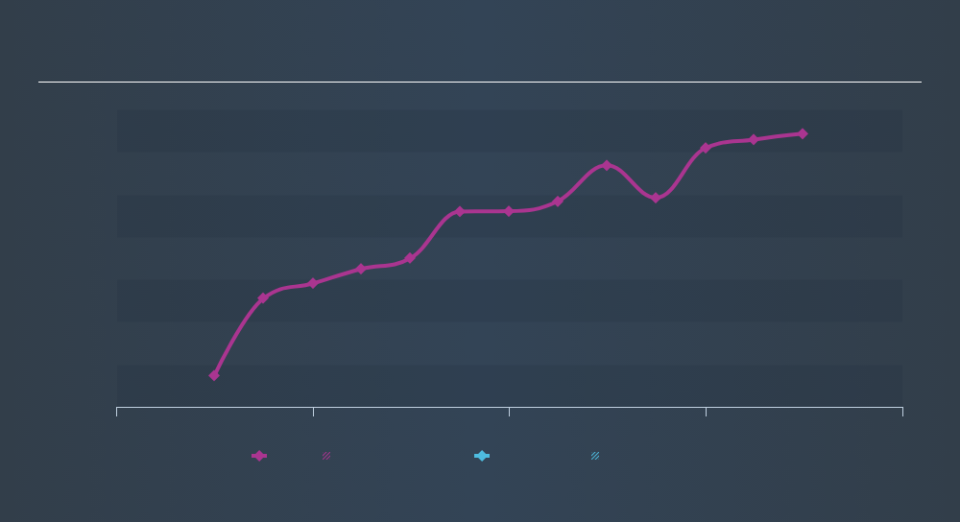

During three years of share price growth, Provident Bancorp achieved compound earnings per share growth of 30% per year. The average annual share price increase of 14% is actually lower than the EPS growth. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Provident Bancorp's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Provident Bancorp shareholders are down 15% for the year, but the broader market is up 2.2%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Investors are up over three years, booking 14% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Before forming an opinion on Provident Bancorp you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.