How Should Investors React To Ambertech's (ASX:AMO) CEO Pay?

Peter Amos became the CEO of Ambertech Limited (ASX:AMO) in 1995, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Ambertech.

See our latest analysis for Ambertech

Comparing Ambertech Limited's CEO Compensation With the industry

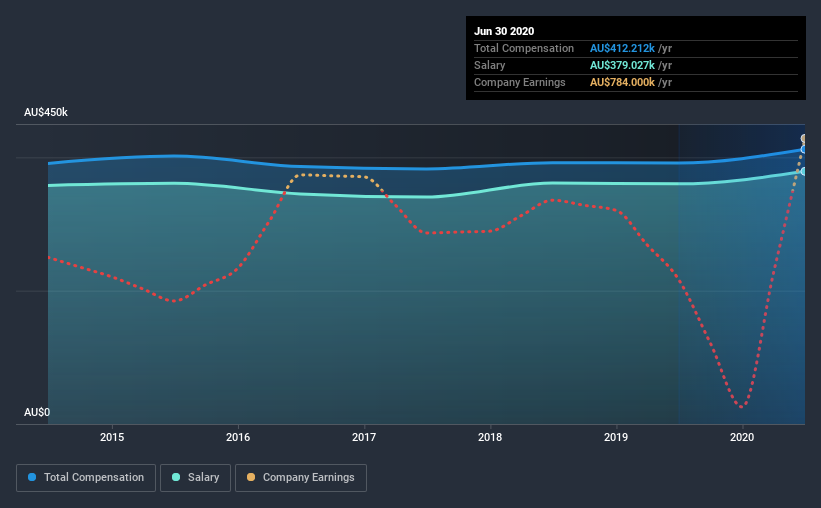

According to our data, Ambertech Limited has a market capitalization of AU$15m, and paid its CEO total annual compensation worth AU$412k over the year to June 2020. That's a fairly small increase of 5.3% over the previous year. We note that the salary portion, which stands at AU$379.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below AU$258m, reported a median total CEO compensation of AU$396k. From this we gather that Peter Amos is paid around the median for CEOs in the industry. Furthermore, Peter Amos directly owns AU$930k worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$379k | AU$360k | 92% |

Other | AU$33k | AU$31k | 8% |

Total Compensation | AU$412k | AU$392k | 100% |

Talking in terms of the industry, salary represented approximately 61% of total compensation out of all the companies we analyzed, while other remuneration made up 39% of the pie. Ambertech pays out 92% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Ambertech Limited's Growth Numbers

Over the last three years, Ambertech Limited has shrunk its earnings per share by 32% per year. In the last year, its revenue is up 2.8%.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Ambertech Limited Been A Good Investment?

Boasting a total shareholder return of 67% over three years, Ambertech Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As previously discussed, Peter is compensated close to the median for companies of its size, and which belong to the same industry. Some investors may take issue with this, especially considering shrinking EPS for the past three years. But on the bright side, shareholder returns have moved northward during the same period. We do not think CEO compensation is a problem, but shareholders might think performance needs to be improved before paying any more.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 3 warning signs for Ambertech (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Important note: Ambertech is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.