IQIYI Calls Active Despite Analyst Warning Before Earnings

IQIYI Inc (NASDAQ:IQ) -- often called the Chinese Netflix -- will report earnings after the close on Monday, Aug. 19. Ahead of the event, J.P. Morgan Securities launched coverage of the stock with an "underweight" rating and $14 price target, representing a record low for IQ shares and an 18% discount to their current price. Nevertheless, IQ stock is up 1% at $17.15 today, as Chinese tech names move higher on the country's stimulus plans. What's more, IQ call options are active, as bulls place eleventh-hour bets ahead of expiration.

Today's negative note from J.P. Morgan Securities was attributed to "soft" demand for online ads, and the analyst expects subscriber sign-ups to be subdued. In fact, the brokerage firm expects IQIYI to downwardly revise its full-year subscriber guidance. However, lackluster analyst attention is nothing new for the shares, as three of the four analysts following IQ stock maintain tepid "hold" ratings.

Short sellers have also been piling on the Chinese name. Short interest grew 2% in the past two reporting periods, and now accounts for a healthy 20% of IQ's total available float. At the stock's average pace of trading, it would take shorts about eight sessions to repurchase their pessimistic positions.

As alluded to earlier, though, options traders today are waxing optimistic on IQ -- at least for the next few hours. So far today, the stock has seen roughly 7,500 calls cross the tape -- two times the average intraday volume. For comparison, fewer than 2,200 puts have changed hands.

Most active are the August 16.50 and 17 calls, where it looks like traders are buying the options to open. By doing so, they expect IQ to extend today's bounce above the strikes through today's close, when the front-month options expire.

That affinity for bullish bets is par for the course for the shares, though. On the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), traders have bought to open nearly three IQ calls for every put in the past two weeks. However, some of that buying -- particularly at out-of-the-money strikes -- could be attributable to the aforementioned short sellers seeking an options hedge in the event of a post-earnings bounce for IQ.

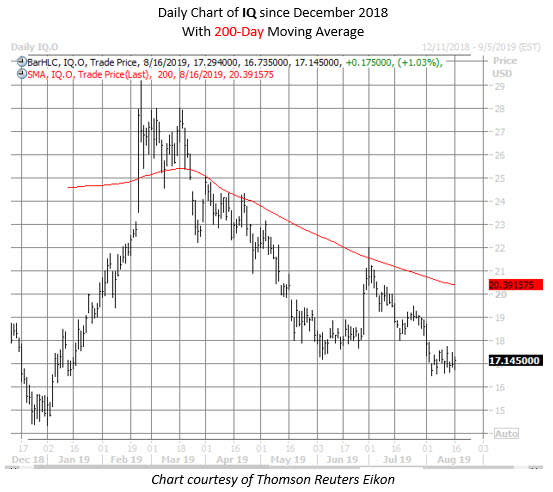

Since touching a year-to-date high above $29 in late February, the stock has surrendered roughly 41%. Subsequent rebound attempts have been halted by IQ's descending 200-day moving average, while the $16.50-$17 region has emerged as a recent floor.