Jana Partners Slashes Top Holding Conagra

- By Graham Griffin

Jana Partners (Trades, Portfolio) has revealed a significant reduction in its top holding Conagra Brands Inc. (NYSE:CAG) according to GuruFocus' Real-Time Picks, a Premium feature.

The activist firm was founded by Barry Rosentein in 2001 and takes a value-orientated approach to investing. The team seeks companies that are undergoing or are expected to undergo changes driven by certain events. They seek to aid value creation by becoming an actively involved shareholder.

On May 6, the firm slashed the Conagra Brands (NYSE:CAG) holding by 25.85% with the sale of 2.80 million shares. On the day of the transaction, the shares climbed to $37.60 per share compared to $22.90 per share the last time the firm added to the holding. Overall, the portfolio saw a -7.15% impact and GuruFocus estimates the total gain of the holding at 13.16%. Conagra Brands still maintains the largest position in the portfolio at a 26.65% weighting.

Conagra Brands is a packaged foods company that operates predominantly in the United States (92% of revenue and 94% of profits). It has a significant presence in the freezer aisle, with brands such as Marie Callender's, Healthy Choice, Banquet and Birds Eye. Other popular brands include Duncan Hines, Hunt's, Slim Jim, Vlasic, Orville Redenbacher's, Reddi-Wip, Wish-Bone and Chef Boyardee. While the majority of revenue is sold into the U.S. retail channel, 9% of fiscal 2020 sales were to the food-service channel, down from 11% in fiscal 2019 due to the pandemic.

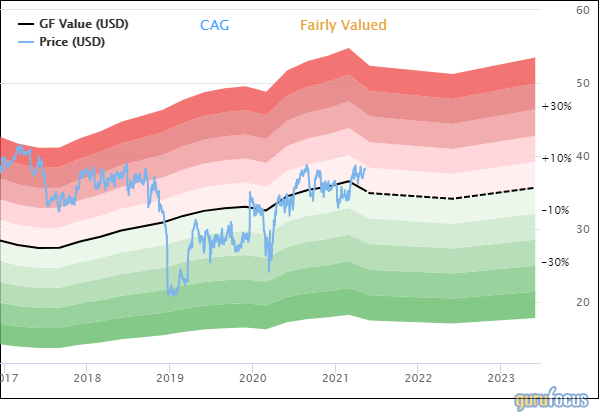

On May 10, the stock was trading at $38.29 per share with a market cap of $18.33 billion. According to the GF Value Line, the shares are trading at a fair value rating.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 6 out of 10 and a valuation rank of 7 out of 10. There are currently no severe warning signs issued for the company. The company's cash-to-debt ratio of 0.01 ranks it worse than 96.77% of competitors and the Altman Z-Score of 1.96 is less than exemplary.

Jana Partners (Trades, Portfolio) is the 10th-largest shareholder with 1.68% of shares outstanding. Other top shareholders include Capital World Investors (Trades, Portfolio), Vanguard Group Inc. (Trades, Portfolio) and BlackRock Inc. (Trades, Portfolio).

Portfolio overview

At the end of the fourth quarter of 2020, Jana Partners (Trades, Portfolio)' portfolio contained 11 stocks with four new holdings. It was valued at $1.48 billion and has seen a turnover rate of 29%. Top holdings at the end of the quarter were Conagra Brands, Perspecta Inc. (NYSE:PRSP), Encompass Health Corp. (NYSE:EHC), Laboratory Corp. of America Holdings (NYSE:LH) and SSGA SPDR S&P 500 (SPY).

By weight, the top three sectors represented are consumer defensive (32.50%), technology (26.49%) and health care (25.70%).

Disclosure: Author owns no stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.