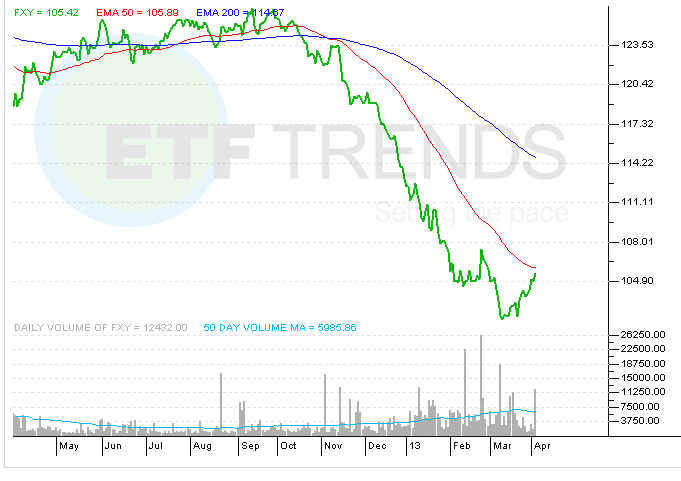

Japanese Yen ETF Plummets on Massive BOJ Easing

CurrencyShares Japanese Yen Trust (FXY) nosedived more than 2% on Thursday after the Bank of Japan unveiled a bold new plan to fight deflation including new easing measures that stunned the market.

The central bank said it plans to double its holdings of government bonds and ETFs the next two years.

Bank of Japan Governor Haruhiko Kuroda said he will do whatever it takes to meet the 2% inflation target.

“Our stance is to take all the policy measures imaginable at this point to achieve the 2% price stability target in two years,” Kuroda said in a Dow Jones Newswires report.

The BOJ bombshell rippled into Japanese stocks, which were sharply higher Thursday. The iShares MSCI Japan (EWJ) vaulted 4.8% before the opening bell while WisdomTree Japan Hedged Equity (DXJ) soared 6.3%. DXJ enjoyed a stronger rally because it hedges its currency exposure to the Japanese yen.

The new BOJ easing measures were even more than the market had expected. New Japanese Prime Minister Shinzo Abe is strongly committed to inflation and a weaker yen to boost the struggling economy. [Yen Rebound May Cool Japan ETF Rally]

DXJ was up 28% for the six months ended April 3. FXY, which tracks the movement of the Japanese yen versus the U.S. dollar, is down about 17% over the same period.

CurrencyShares Japanese Yen Trust

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.