Jerash Holdings (US) (NASDAQ:JRSH) Has Re-Affirmed Its Dividend Of US$0.05

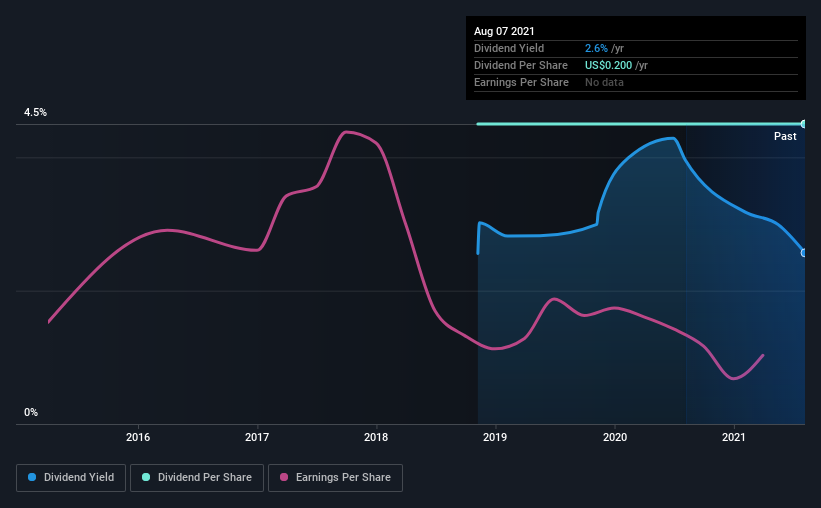

The board of Jerash Holdings (US), Inc. (NASDAQ:JRSH) has announced that it will pay a dividend of US$0.05 per share on the 24th of August. Based on this payment, the dividend yield on the company's stock will be 2.6%, which is an attractive boost to shareholder returns.

See our latest analysis for Jerash Holdings (US)

Jerash Holdings (US)'s Earnings Easily Cover the Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Jerash Holdings (US) was earning enough to cover the dividend, but it wasn't generating any free cash flows. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

Looking forward, earnings per share is forecast to rise by 61.0% over the next year. If the dividend continues on this path, the payout ratio could be 34% by next year, which we think can be pretty sustainable going forward.

Jerash Holdings (US) Doesn't Have A Long Payment History

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. The last annual payment of US$0.20 was flat on the first annual payment 3 years ago. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. Unfortunately things aren't as good as they seem. Jerash Holdings (US)'s earnings per share has shrunk at 19% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Jerash Holdings (US)'s Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While Jerash Holdings (US) is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 4 warning signs for Jerash Holdings (US) (1 makes us a bit uncomfortable!) that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.