Johnson & Johnson Rises on 1st-Quarter Earnings Beat

- By James Li

Shares of Johnson & Johnson (NYSE:JNJ) surged over 2% in morning trading on Tuesday on the back of the company reporting first-quarter revenue and earnings that topped consensus estimates.

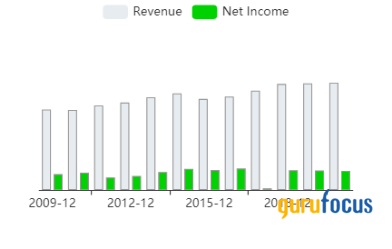

For the quarter ending March 31, the New Brunswick, New Jersey-based drug manufacturer reported net income of $6.197 billion, or diluted earnings of $2.32 per share, compared with net income of $5.796 billion, or diluted earnings of $2.17 per share, in the prior-year quarter. Revenue of $22.321 billion topped the Refinitiv consensus estimate of $21.98 billion while adjusted earnings of $2.59 per share topped the consensus estimate of $2.34 per share.

Covid-19 vaccine boosts pharmaceutical business revenue despite blood clot issues

Johnson & Johnson said that revenue in its pharmaceutical business increased 9.6% year over year to approximately $12.199 billion during the quarter, driven by strong growth in treatments like Stelera for Crohn's disease and Tremfya for psoriasis. Additionally, the company reported $100 million in sales for its one-shot Covid-19 vaccine.

Chief Financial Officer Joseph Wolk said in a CNBC interview that regarding its Covid-19 vaccine and other related products, safety is "the utmost importance" and that regulators around the world are "motivated by" the same ambitions. Wolk underscored that despite the small cases of blood clots, management has "strong conviction" in the benefit-risk profile: Johnson & Johnson's vaccine requires just one dose and has low refrigeration requirements.

Wolk discussed that the temporary pause in vaccine distribution may engender confidence in people getting vaccinated and that getting vaccines into the arms of "underserved populations" domestically and internationally remains a viable solution to curb the spread of the coronavirus.

Stock rises on revenue and earnings beat

Shares of Johnson & Johnson traded around $167.34, up 2.86% from Monday's close of $162.69 on the company's revenue and earnings beat. The stock is modestly overvalued based on Tuesday's price-to-GF Value ratio of 1.13.

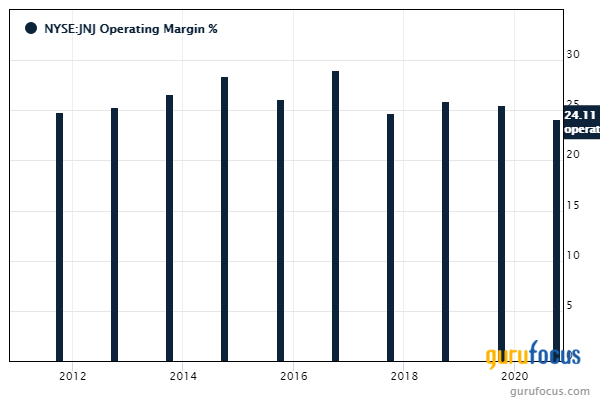

GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include profit margins and returns outperforming over 80% of global competitors.

Gurus with large holdings in Johnson & Johnson include Pioneer Investments (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio)'s GMO and Yacktman Asset Management (Trades, Portfolio).

Disclosure: Long Johnson & Johnson.

Read more here:

Yacktman Fund's Top 5 1st-Quarter Trades

T Rowe Price Equity Income Fund's Top 4 1st-Quarter Trades

New Feature: GuruFocus User Stock Notes

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.