June Undervalued Dividend Stock Picks

Undervalued dividend stocks such as Pendragon and Henry Boot can help diversify the constant stream of cash flows generated by your portfolio through both steady dividend income and expected capital gains over time. Today I will share with you my mispriced dividend-paying companies you should be considering for your portfolio.

Pendragon PLC (LSE:PDG)

Pendragon PLC, together with its subsidiaries, operates as an automotive retailer company in the United Kingdom and California. Formed in 1988, and currently lead by Trevor Finn, the company size now stands at 9,352 people and with the market cap of GBP £367.28M, it falls under the small-cap stocks category.

Over the past 10 years, Pendragon has been distributing dividends back to its shareholders, with a recent yield of 6.13%. PDG’s yield exceeded United Kingdom’s top dividend payer average yield of 4.36%. The company’s payout ratio currently stands at 41.37%, illustrating that its dividend payments are well-covered by its earnings. In addition to this, PDG is also undervalued by 38.30%, making PDG an attractive investment at the current share price of UK£0.26. Continue research on Pendragon here.

Henry Boot PLC (LSE:BOOT)

Henry Boot PLC invests in, develops, and trades in properties in the United Kingdom. Formed in 1886, and now led by CEO John Sutcliffe, the company currently employs 486 people and with the stock’s market cap sitting at GBP £385.87M, it comes under the small-cap stocks category.

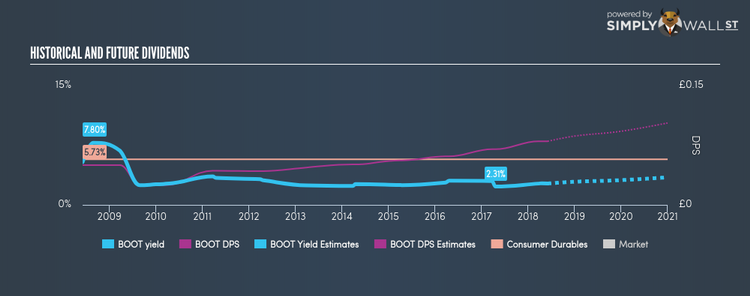

Henry Boot has been paying dividend over the past 10 years. It currently paid an annual dividend of UK£0.08, resulting in a dividend yield of 2.69%. At the current payout ratio of 24.90%, BOOT has been able to sensibly grow its dividend per share in the last 10 years, raising its yield to above United Kingdom’s low risk savings rate of 1.73%. BOOT is trading below its intrinsic value by 40.19%, meaning BOOT can be bought at an attractive price right now. Interested in Henry Boot? Find out more here.

SThree plc (LSE:STHR)

SThree plc provides recruitment services for science, technology, engineering, and mathematics industries. Formed in 1986, and currently run by Gary Elden, the company provides employment to 2,866 people and has a market cap of GBP £401.93M, putting it in the small-cap category.

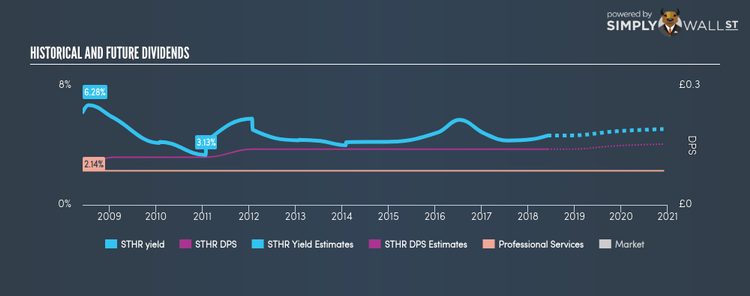

Over the past 10 years, SThree has been distributing dividends back to its shareholders, with a recent yield of 4.36%. At the current payout ratio of 65.17%, STHR has been able to sensibly grow its dividend per share in the last 10 years, raising its yield to above United Kingdom’s low risk savings rate of 1.73%. In addition to this, STHR is also undervalued by 37.76%, making STHR an attractive investment at the current share price of UK£3.21. More on SThree here.

For more mispriced dividend stocks to add to your portfolio, explore this interactive list of undervalued dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.