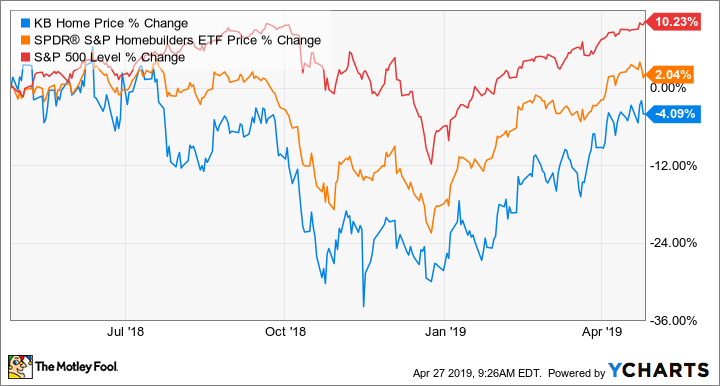

KB Home Has a Lot to Prove in 2019

Any numbers that a homebuilder produces in the first quarter of the year need to be taken with a huge grain of salt. So even though KB Home (NYSE: KBH) produced slightly better-than-expected results and management seemed upbeat, there are some major challenges ahead for the company as it makes some changes to its operating model.

Let's take a look at what the company's most recent results mean for KB Home's future in 2019 and beyond.

Image source: Getty Images.

By the numbers

Metric | Q1 2019 | Q4 2018 | Q1 2018 |

|---|---|---|---|

Revenue | $811 million | $1.35 billion | $871.6 million |

Homebuilding operating income | $32 million | $122.4 million | $44.1 million |

Net income | $30 million | $96.8 million | ($71.2 million) |

EPS (diluted) | $0.31 | $0.96 | ($0.82) |

DATA SOURCE: KB HOME EARNINGS RELEASE. EPS = EARNINGS PER SHARE.

Entering the first quarter, there weren't a lot of promising signs for KB Home. For one, sales were on the decline, as mortgage rates were inching closer to 5% and customers were experiencing a bit of sticker shock on new home prices. KB Home was particularly sensitive to this because a larger portion of its portfolio is in the high-price California market.

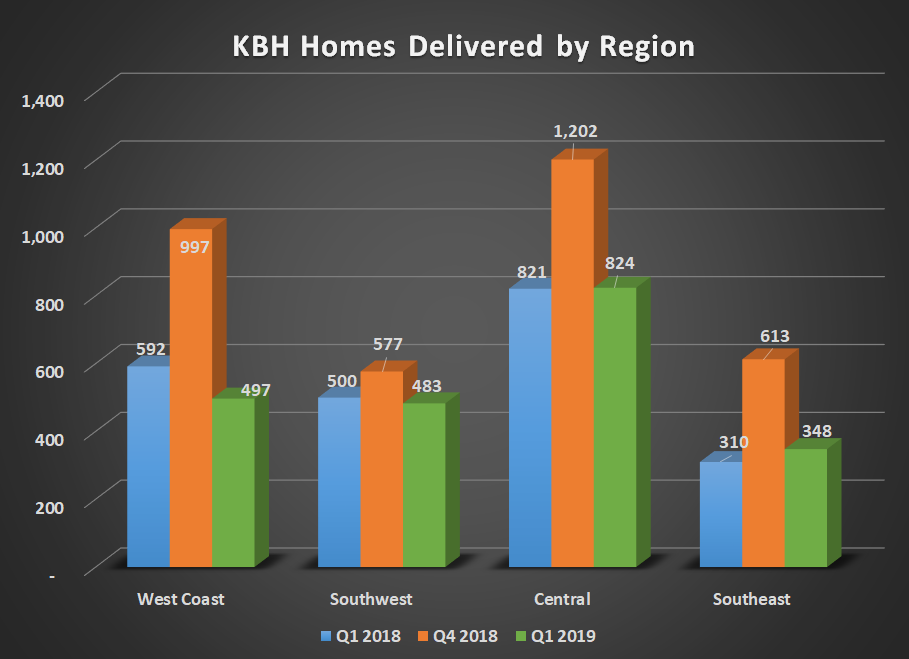

This past quarter's results were very much a reflection of that. Revenue was down overall even though its other regions had mostly flat sales. It was its West Coast region's results that led to most of the declines.

Source: KB Home earnings release. Chart by author.

The one silver lining in these results is that the company's margins didn't suffer that much from the decline in sales. The company reported a gross margin of 17.1% for the quarter, which was up a full percentage point from this time last year. Some of that gross margin gain was from accounting rules, though, so it will be worth following up in future quarters to see if the company is making efficiency gains or if this is all accounting changes.

US 30 Year Mortgage Rate data by YCharts.

What management had to say

The first quarter is almost always a time when homebuilders get geared up for the spring selling season. According to CEO Jeffrey Mezger, KB Home should be well positioned with a significant uptick in communities across all of its regions.

We are beginning to see healthy growth in our average community count, which was up 10% in the first quarter. This increase, together with a substantial number of planned openings still to come, positions us to capitalize on demand during the spring selling season. Although the decline in net orders during the 2018 fourth quarter impacted our first-quarter housing revenues, we are encouraged by improving market conditions, which we believe should enable us to generate stronger revenues in the 2019 second half.

Mixed signals

As a business, KB Home has been a serial underperformer in the housing business. Its margins tend to be on the low end of the industry because it offers lots of customization options to potential buyers while maintaining lower price points. That sounds like a great sales pitch to customers, but it hasn't translated to better-than-average sales growth to make up for lower margins.

KB Home was the apple of Wall Street's eye in 2017 and 2018, as many analysts assumed that it had more room to improve margins and improve the bottom line. That theory seems to have gone out the window, though, as several analysts have started to downgrade the stock. It's hard to improve margins when this particular market approach has inherently lower margins.

It's also a bit strange that management said that community growth was evenly spread among its regions. It wasn't that long ago that management was saying that it wanted to become less reliant on its West Coast region.

While the company's stock trades at a seemingly cheap price with an earnings ratio of nine and the spring selling season will likely lead to higher sales, its valuation is still in line with many of its peers. It's hard to justify paying the same price for a company that tends to underperform its industry.

More From The Motley Fool

Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.