Some KUKA (ETR:KU2) Shareholders Have Copped A Big 59% Share Price Drop

If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term KUKA Aktiengesellschaft (ETR:KU2) shareholders. Regrettably, they have had to cope with a 59% drop in the share price over that period. The more recent news is of little comfort, with the share price down 36% in a year. The good news is that the stock is up 1.9% in the last week.

Check out our latest analysis for KUKA

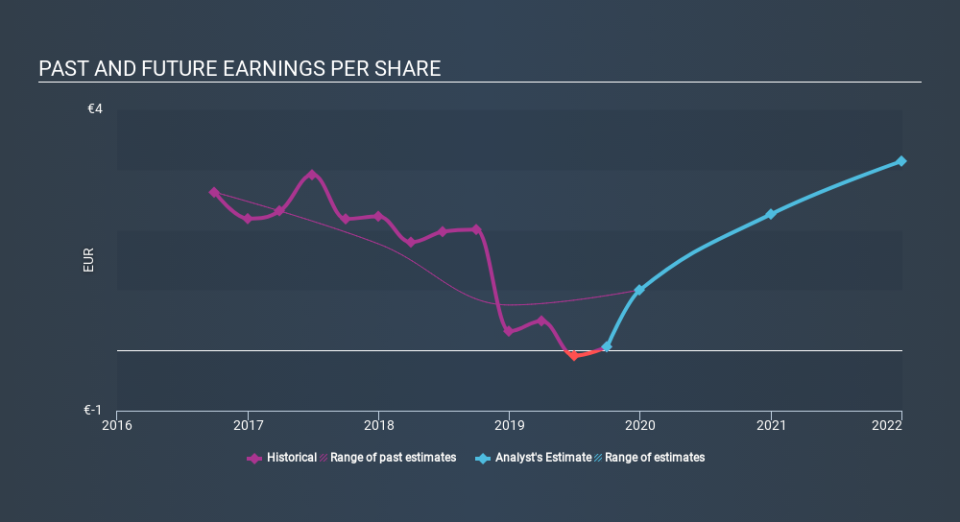

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

KUKA saw its EPS decline at a compound rate of 72% per year, over the last three years. This fall in the EPS is worse than the 25% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. This positive sentiment is also reflected in the generous P/E ratio of 620.27.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into KUKA's key metrics by checking this interactive graph of KUKA's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 19% in the last year, KUKA shareholders lost 35% (even including dividends) . Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9.1% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for KUKA that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.