Lockheed Martin (LMT) Adds Germany to Its F-35 Customer List

Lockheed Martin Corporation LMT recently inked a deal with the German Ministry of Defense involving the supply of its fifth-generation F-35 Lightning II aircraft. With this deal, Germany becomes the ninth foreign military sales (FMS) country to include F-35 in its family of aircraft.

Per the deal, LMT will deliver 35 F-35 Lightning II jets to Germany to meet the country’s defense requirements. The United States has been backing the European countries for their security and defense needs for many years, with the aforementioned agreement strengthening America’s alliance with the European countries.

The agreement also entails the delivery of a comprehensive package of engines, role-specific mission equipment, spare and replacement parts, technical and logistic support, training and armament requirements.

F-35 to Continue Boosting LMT’s Growth Prospects

F-35 has been dominating the military aircraft arena for many years. It is anticipated to be the top choice for military missions in the years to come, backed by its super-advanced technology.

F-35 is a multi-role fighter capable of successfully executing any kind of mission, including new missions not traditionally fulfilled by legacy fighters. Additionally, its ability to collect, analyze and share data is a powerful force multiplier that enhances all airborne, surface and ground-based assets in the battlespace.

Such features have made the aircraft the most desirable choice for many nations. Apart from eight international program partners, F-35 is being procured by eight other FMS customers. Prior to Germany, Switzerland joined the consortium of FMS customers in 2022.

F-35 is expected to continue to top the list of military aircraft demand for many years to come as the U.S. Government boasts a current inventory objective of 2,456 aircraft for the U.S. Air Force, U.S. Marine Corps and U.S. Navy, commitments from seven international partner countries and eight FMS customers and interests from other countries.

The strong demand can also be gauged by a solid backlog of 271 production aircraft at the end of the third quarter of 2022, which will continue to augment the top line of the company. With nations increasing their defense spending to strengthen their defense structure, F-35 may witness more nations joining the program, thus adding to its wide prospects of intensified demand.

Peers to Benefit

Defense majors that play a critical role in manufacturing the stealth aircraft and are thus likely to benefit from the strong demand are as follows:

Northrop Grumman NOC plays a critical role in the development, demonstration, production and sustainment of F-35. It is accountable for the production of the center fuselage and the design and production of the AN/APG-81 Active Electronically Scanned Array fire control radar, the AN/AAQ-37 Distributed Aperture System and the AN/ASQ-242 Communications, Navigation and Identification avionics suite, etc.

Northrop Grumman has a long-term earnings growth rate of 6.2%. Its investors have gained 36.6% in the past year.

BAE Systems BAESY brings its military aircraft expertise to the development, manufacture, integration and sustainment of the F-35. The fuselage, vertical and horizontal tails and the electronic warfare suite are being provided by BAESY for the F-35 model.

BAE Systems boasts a long-term earnings growth rate of 5.3%. BAESY stock has appreciated 31.2% in the past year.

Price Movement

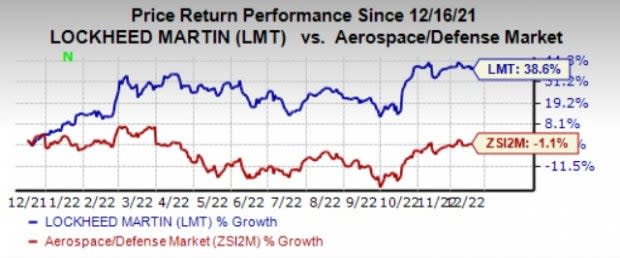

In the past year, shares of Lockheed Martin have rallied 38.6% against the industry’s fall of 1.1%.

Image Source: Zacks Investment Research

Zacks Rank

Lockheed Martin currently carries a Zacks Rank #3 (Hold). A better-ranked stock from the same sector is Triumph Group TGI, which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Triumph Group boasts a long-term earnings growth rate of 2.6%. The Zacks Consensus Estimate for 2023 earnings indicates an improvement of 70% in the past 60 days.

TGI delivered an earnings surprise of 275% in the last reported quarter. The Zacks Consensus Estimate for 2024 earnings suggests a growth rate of 6% from the 2023 estimated figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Triumph Group, Inc. (TGI) : Free Stock Analysis Report

Bae Systems PLC (BAESY) : Free Stock Analysis Report