Low Expectations make Micron Technology (NASDAQ:MU) a Defensive Tech Stock with Potential for Upside

This article originally appeared on Simply Wall St News.

Last week Micron Technology ( NASDAQ:MU ) released second quarter results. The results were comfortably ahead of forecasts, and guidance for the third quarter was raised. After initially gaining 4.7%, the share price tracked the sector lower.

Micron has very low expectations priced into its current valuation. At the same time, data center demand appears to be stronger than expected , and if that continues expectations could improve meaningfully.

Second quarter results at a glance:

EPS: $2.14, up 118% year on year and 16 cents ahead of consensus estimates.

GAAP EPS: $2.00, up 277% year on year and 16 cents ahead of consensus estimates.

Revenue: $7.78 bln, up 24.8% year on year and $244 mln better than expected.

Demand and prices for NAND and DRAM memory chips continue to rise.

Data center demand for memory and storage is expected to outpace broader markets over next decade.

Third quarter guidance: Revenue estimate raised from $8.1 bln to ~$8.7 bln and EPS from $2.21 to ~$2.33.

Micron’s near-term outlook has improved, although it's unlikely to match the last quarter's earnings growth. But what really matters for investors is the expectations that are currently priced into the stock and how they may change over time.

How does Micron Measure up against the Tech Sector and Semiconductor Industry?

If you look at the Simply Wall St Markets page , you can view the price-to-earnings ratio and forecast earnings growth rates for each sector, and for each industry within each sector.

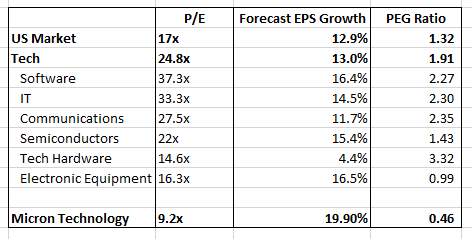

We can see that the average P/E ratio for semiconductor stocks is 22x, which is the third lowest amongst the six industries, and considerably lower than the software industry which is at 37.3x.

When we look at forecast growth rates, the semiconductor industry is expected to grow at 15.4%, which is only slightly lower than the software and electronic equipment industries.

We can also combine the P/E ratio and growth forecast by calculating a ‘PEG’ (P/E to Growth) ratio. By dividing the P/E ratio by the expected growth rate we arrive at values that are easier to compare . We can add Micron to the list two to see how it compares to the market, the tech sector, and the semiconductor industry.

The current PEG ratios suggest that the semiconductor industry is more favorably valued relative to growth expectations than all the tech industries apart from electronic equipment. This doesn’t imply semiconductor stocks will perform better, but that expectations relative to forecasts are currently lower.

Micron Technology’s P/E and PEG suggest expectations are even lower. The current forecast EPS growth rate for the next few years is 19.9%. While EPS increased by 182% over the last year, analysts are expecting a sharp slowdown in the next few years.

Demand and prices for memory and storage chips is cyclical, so revenues are typically lumpy. In truth it's difficult to forecast demand more than a year or two ahead, so analyst estimates are understandably conservative - and their forecasts are likely to change. The good news for investors is that these forecasts are low, and the current P/E is low relative to those forecasts.

What does this mean for investors?

The bottom line here is that Micron is currently seeing strong demand for its products, while the market's expectations for the future are low. This contrasts with a lot of other technology stocks that have optimistic forecasts and even more optimistic valuations. This suggests downside for Micron could be limited, while there is potential for substantial upside if the longer-term outlook improves.

To learn more about the company, have a look at our latest analysis for Micron Technology . You can use the Simply Wall St Screener to find other semiconductor stocks with strong fundamentals.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.