Lumen (LUMN) Q3 Earnings Top Estimates, Revenues Down Y/Y

Lumen Technologies, Inc. LUMN reported mixed third-quarter 2021 results, with the bottom line beating the Zacks Consensus Estimate but the top line missing the same. Lower revenues in the Business and Mass Markets segments owing to the COVID-19 turmoil along with weak demand for IP and Data services led to year-over-year top-line deterioration.

Bottom Line

Net income in the September quarter was $544 million or 51 cents per share compared with $366 million or 34 cents per share in the year-ago quarter. The year-over-year improvement, despite top-line contraction, was mainly driven by lower operating expenses.

Excluding special items, adjusted net income came in at $521 million or 49 cents per share compared with $384 million or 35 cents per share in the prior-year quarter. The bottom line beat the Zacks Consensus Estimate by 11 cents.

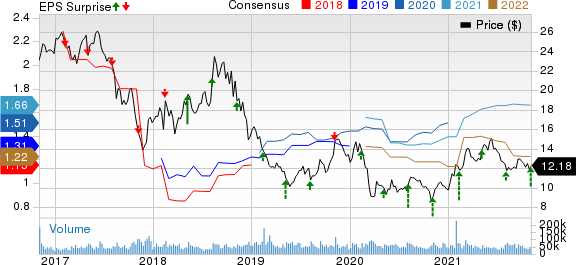

Lumen Technologies, Inc. Price, Consensus and EPS Surprise

Lumen Technologies, Inc. price-consensus-eps-surprise-chart | Lumen Technologies, Inc. Quote

Top Line

Quarterly total revenues slipped 5.4% year over year to $4,887 million owing to a challenging macroeconomic environment. The top line missed the consensus estimate of $4,920 million.

By segment, Business revenues fell 5.1% to $3,508 million due to lower sales in the Large Enterprise, Mid-Market Enterprise, and Wholesale markets. Soft demand for IP and Data services due to declines in new VPN Hybrid Network deployments with a reduction in voice revenues acted as major headwinds as well. Revenues from Mass Markets decreased to $1,379 million from $1,469 million in the year-earlier quarter, led by a decline in voice revenues.

IGAM revenues grew 0.6% year over year to $1,019 million as a result of higher demand for wavelengths and dark fiber within Fiber Infrastructure Services. Revenues from Large Enterprise declined 5.9% to $932 million due to COVID-19-led lower sales. Mid-Market Enterprise revenues fell to $666 million from $737 million in the year-ago quarter. Revenues in Wholesale tumbled 7% to $891 million.

Lumen anticipates witnessing healthy momentum in Quantum investments and fiber to the home investment strategy to bolster the growth of consumer and small business markets in the upcoming quarters. The company tapped 774,000 quantum fiber subscribers in the reported quarter.

Other Quarterly Details

Total operating expenses decreased 12.2% year over year to $3,756 million, primarily due to lower depreciation and amortization expense. Operating income was $1,131 million compared with $888 million in the prior-year quarter. Adjusted EBITDA (excluding special items) slipped to $2,078 million from $2,132 million for respective margins of 42.5% and 41.3%.

Cash Flow & Liquidity

In the first nine months of 2021, Lumen generated $4,894 million of net cash from operations compared with $4,842 million in the year-ago period. Free cash flow (excluding cash special items) in the quarter was $1,072 million compared with $879 million in the prior-year quarter. As of Sep 30, 2021, the company had $635 million in cash and cash equivalents with $27,260 million of long-term debt. The company completed its $1 billion stock repurchase program in October 2021.

2021 Outlook

For 2021, Lumen expects adjusted EBITDA in the range of $8.4-$8.6 billion. Adjusted free cash flow is projected between $3.6 billion and $3.8 billion, up from $3.1-$3.3 billion expected earlier. Capital expenditures are estimated between $2.8 billion and $3 billion compared with prior expectations of $3.2-$3.5 billion.

Moving Ahead

Despite soft revenues, Lumen ended the quarter with solid free cash flow generation driven by effective capital allocation priorities. Strategic partnerships and incremental investments in platform capabilities make it well-positioned to deliver an enhanced customer experience. Based on these focused endeavors, Lumen expects to achieve its financial targets in the long run. The Monroe, LA-based company’s Quantum Fiber platform and IP-based network capacity also position it well to support customers and deliver long-term shareholders’ value.

Zacks Rank & Stocks to Consider

Lumen currently has a Zacks Rank #3 (Hold).

Few better-ranked stocks in the industry are Riot Blockchain, Inc. RIOT, AstroNova, Inc. ALOT, and Coursera, Inc. COUR. While Riot Blockchain sports a Zacks Rank #1 (Strong Buy), AstroNova and Coursera carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Riot Blockchain delivered a trailing four-quarter earnings surprise of 113.8%, on average.

AstroNova delivered a trailing four-quarter earnings surprise of 79.2%, on average.

Coursera delivered a trailing four-quarter earnings surprise of 32.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstroNova, Inc. (ALOT) : Free Stock Analysis Report

Riot Blockchain, Inc. (RIOT) : Free Stock Analysis Report

Lumen Technologies, Inc. (LUMN) : Free Stock Analysis Report

Coursera, Inc. (COUR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research