Magellan Midstream (MMP) Q4 Earnings Beat, Revenues Miss

An Earnings Beat:Pipeline operator Magellan Midstream Partners L.P. MMP reported adjusted earnings per unit of $1.31, ahead of the Zacks Consensus Estimate of $1.18. Strong contribution from the Crude Oil and Refined Products operating segments led to the beat.

Estimate Revision Trend & Surprise History: The stock had seen the Zacks Consensus Estimate for fourth-quarter earnings remain essentially unmoved over the last 7 days.

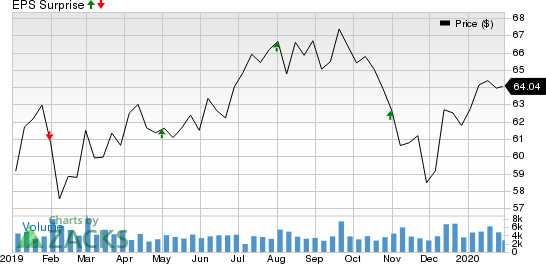

Coming to earnings surprise history, the partnership is on a solid footing, having gone past the Zacks Consensus Estimate in three of the last four reports, with the average positive surprise being %. This is shown in the chart below:

Magellan Midstream Partners, L.P. Price and EPS Surprise

Magellan Midstream Partners, L.P. price-eps-surprise | Magellan Midstream Partners, L.P. Quote

Revenue Underperformance: Magellan Midstream reported revenues of $740.7 million, below the Zacks Consensus Estimate of $852.5 million.

Key Stats: Operating margin from the Refined Products segment was $264.9 million compared with $349.3 million in the year-ago quarter.

Magellan Midstream’s Crude Oil unit generated $151.3 million of operating margin in the quarter compared to $129.8 million for the same period in 2018.

For the Marine Storage division, operating margin was $32.9 million, 7.4% higher than the $30.7 million earned in the year-ago period.

Magellan Midstream reported that its distributable cash flow (DCF) for fourth-quarter 2019 came in at $357.8 million, up 18.3% from the year-ago quarter.

2020 Guidance: Management expects to generate distributable cash flows of approximately $1.2 billion for the full year and is targeting annual distribution growth of 3%. Magellan Midstream guided towards first-quarter and full-year earnings per unit of $1.08 and $4.30, respectively.

The partnership plans to spend $400 million to complete certain expansion projects in 2020. Additionally, Magellan Midstream continues to look out for more than $500 million of potential organic growth projects in the earlier stages of development

Zacks Rank: Currently, Magellan Midstream carries a Zacks Rank #3 (Hold).

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Magellan Midstream Partners, L.P. (MMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.