Who Are The Major Shareholders In Bonanza Creek Energy Inc (BCEI)?

In this analysis, my focus will be on developing a perspective on Bonanza Creek Energy Inc’s (NYSE:BCEI) latest ownership structure, a less discussed, but important factor. The impact of a company’s ownership structure affects both its short- and long-term performance. Since the same amount of capital coming from an activist institution and a passive mutual fund has different implications on corporate governance, it is a useful exercise to deconstruct XYZ’s shareholder registry. All data provided is as of the most recent financial year end.

View our latest analysis for Bonanza Creek Energy

Institutional Ownership

In BCEI’s case, institutional ownership stands at 70.70%, significant enough to cause considerable price moves in the case of large institutional transactions, especially when there is a low level of public shares available on the market to trade. However, as not all institutions are alike, such high volatility events, especially in the short-term, have been more frequently linked to active market participants like hedge funds. Hedge funds, considered active investors, hold a 24.38% stake in the company, which may be the cause of high short-term volatility in the stock price. We should dig deeper into the company’s ownership structure to find how the rest of its ownership structure can impact its investment case.

Insider Ownership

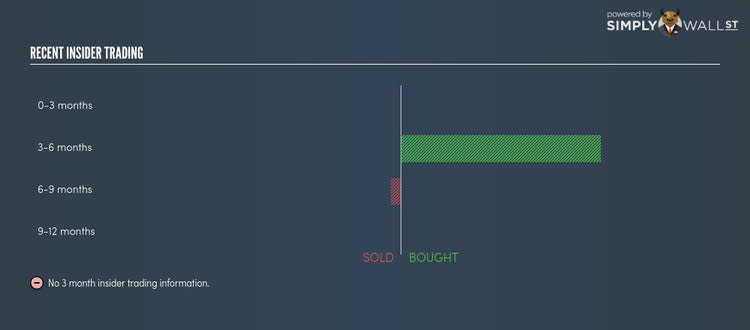

Another important group of shareholders are company insiders. Insider ownership has to do more with how the company is managed and less to do with the direct impact of the magnitude of shares trading on the market. Although individuals in BCEI hold only a minor stake, it’s a good sign for shareholders as the company’s executives and directors have their incentives directly linked to the company’s performance. It would also be interesting to check what insiders have been doing with their shareholding recently. Insider buying can be a positive indicator of future performance, but a selling decision can be simply driven by personal financial requirements.

General Public Ownership

With 4.55% ownership, the general public are a relatively smaller ownership class in BCEI. This size of ownership may not be enough to sway a policy decision in their favour, but they can still make a collective impact on company policies if it aligns with other large shareholders.

What this means for you:

Are you a shareholder? With significant institutional ownership, including active hedge, existing investors should seek a margin of safety when investing in BCEI. This will allow an investor to reduce the impact of non-fundamental factors, such as volatile block trading impact on their portfolio value. If you’re looking to diversify your holdings with high-quality stocks, our free analysis platform has a selection of high-quality stocks with a strong growth potential.

Are you a potential investor? Ownership structure should not be the only focus of your research when constructing an investment thesis around BCEI. Rather, you should be looking at fundamental drivers like the future growth expectations around BCEI, which is a key factor that will influence BCEI’s share value. Take a look at our most recent infographic report on BCEI for a more in-depth analysis of these factors to help you make a more well-informed investment decision.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.