March Top Undervalued Companies

Stocks, such as Air Canada, trading at a market price below their true values are considered to be undervalued. Investors can benefit from buying these companies while they are discounted, because they gain when the market prices move towards the stocks’ true values. Below is a list of stocks I’ve compiled that are deemed undervalued based on the latest financial data.

Air Canada (TSX:AC)

Air Canada provides domestic, U.S. transborder, and international airline services. Founded in 1937, and now led by CEO Calin Rovinescu, the company provides employment to 27,800 people and has a market cap of CAD CA$7.42B, putting it in the mid-cap stocks category.

AC’s stock is now trading at -75% lower than its value of $109.3, at the market price of CA$27.16, according to my discounted cash flow model. This discrepancy gives us a chance to invest in AC at a discount. In terms of relative valuation, AC’s PE ratio is around 3.64x against its its Airlines peer level of, 5.85x indicating that relative to its comparable company group, AC’s shares can be purchased for a lower price. AC is also strong financially, as short-term assets amply cover upcoming and long-term liabilities. The stock’s debt-to-equity ratio of 181.09% has been reducing for the last couple of years signalling its capacity to reduce its debt obligations year on year. More detail on Air Canada here.

Celestica Inc. (TSX:CLS)

Celestica Inc. provides supply chain solutions in Canada and internationally. Formed in 1996, and now run by Robert Mionis, the company size now stands at 23,000 people and with the company’s market capitalisation at CAD CA$1.99B, we can put it in the small-cap group.

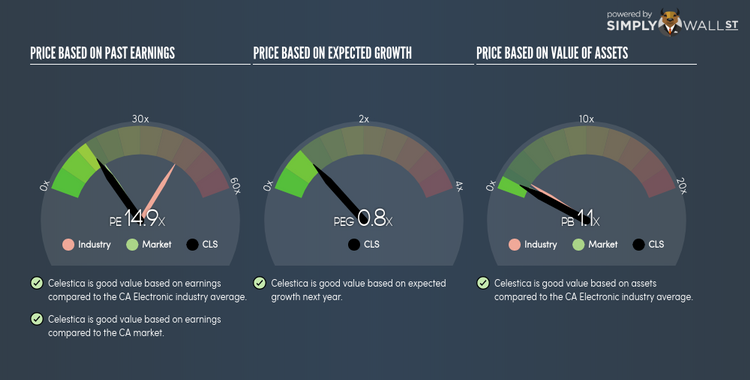

CLS’s shares are now trading at -22% beneath its true level of $17.91, at a price tag of CA$14.04, based on my discounted cash flow model. The divergence signals an opportunity to buy CLS shares at a low price. Additionally, CLS’s PE ratio is around 14.92x while its Electronic peer level trades at, 43.52x meaning that relative to its peers, you can buy CLS for a cheaper price. CLS is also in great financial shape, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

Continue research on Celestica here.

AutoCanada Inc. (TSX:ACQ)

AutoCanada Inc., through its subsidiaries, operates franchised automobile dealerships in Canada. Founded in 2009, and currently run by Steven Landry, the company currently employs 4,250 people and with the market cap of CAD CA$566.13M, it falls under the small-cap stocks category.

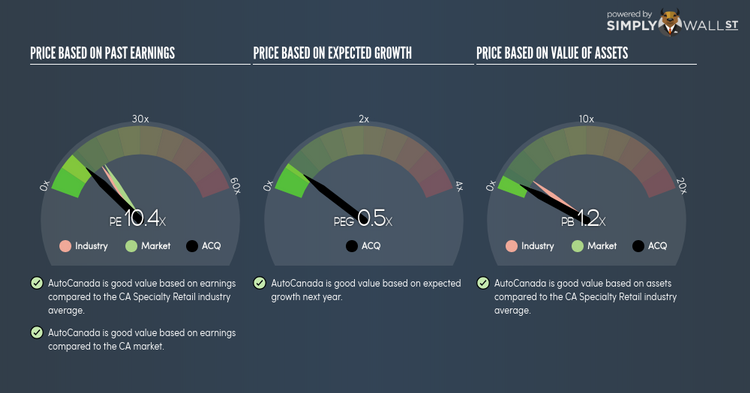

ACQ’s shares are currently floating at around -28% beneath its actual worth of $28.52, at a price of CA$20.67, based on my discounted cash flow model. The divergence signals an opportunity to buy ACQ shares at a low price. Furthermore, ACQ’s PE ratio is around 10.37x compared to its Specialty Retail peer level of, 14.9x meaning that relative to its comparable company group, ACQ’s shares can be purchased for a lower price. ACQ is also strong financially, with near-term assets able to cover upcoming and long-term liabilities. Finally, its debt relative to equity is 182.48%, which has been reducing over time, signalling its capability to pay down its debt. Continue research on AutoCanada here.

Or create your own list by filtering TSX companies based on fundamentals such as intrinsic discount, health score and future outlook using this free stock screener.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.