Marriott Vacations (VAC) Raises Q2 Contract Sales Guidance

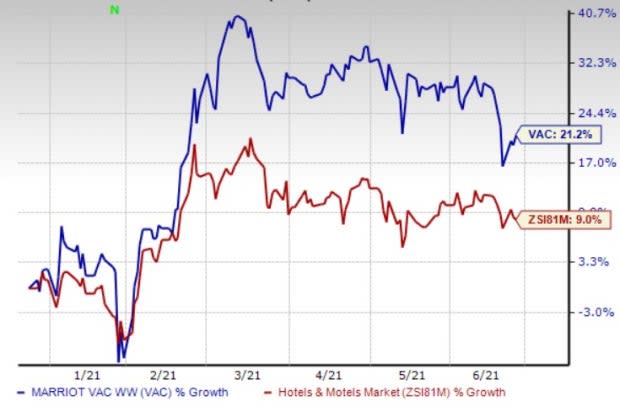

Marriott Vacations Worldwide Corporation VAC recently updated its second-quarter 2021 outlook. The company continues to witness robust recovery during second-quarter 2021. Following the news, its shares increased 1.4% on Jun 23. Notably, the stock has gained 21.2% in the past six months, compared with the industry’s growth of 9%.

Both occupancies and tours are witnessing sequential growth in the second quarter, while VPGs remain well above 2019 levels. The company anticipates contract sales in the range of $345 million to $355 million in the second quarter, up from the prior estimate of $320 million to $340 million. Contract sales are likely to increase 55% sequentially at the mid-point of aforementioned estimated guidance.

Image Source: Zacks Investment Research

Occupancy Increasing Gradually

Following the reopening of resorts in May 2020, Marriott Vacations has been witnessing sequential improvement in occupancy rates, thereby highlighting people’s willingness to go on vacations. During first-quarter 2021, the company witnessed strong occupancy rates at short-haul fly-to locations. Notably, occupancy rates at Florida Beach resorts increased in the high-80% range, while occupancy rates in South Carolina resorts, and Colorado and Utah Mountain resorts rose 80% and 85%, respectively. Moreover, U.S. Virgin Island resorts reported occupancy rates of more than 85% during the quarter.

Strong revenue-building capacities and digital innovations are likely to boost the company's prospects. Marriott Vacations, which shares space with Choice Hotels CHH, Hilton Grand Vacations Inc. HGV and Playa Hotels & Resorts N.V. PLYA, carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Marriot Vacations Worldwide Corporation (VAC) : Free Stock Analysis Report

Hilton Grand Vacations Inc. (HGV) : Free Stock Analysis Report

Playa Hotels & Resorts N.V. (PLYA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research