May Top Dividend Stock

Guess’ is one of companies on my list of top dividend stocks. Dividend stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A sizeable part of portfolio returns can be produced by dividend stocks due to their contribution to compounding returns in the long run. Below are more huge dividend-paying stocks that continues to add value to my portfolio holdings.

Guess’, Inc. (NYSE:GES)

Guess?, Inc. designs, markets, distributes, and licenses lifestyle collections of apparel and accessories for men, women, and children. Started in 1981, and headed by CEO Amigo Herrero, the company size now stands at 14,700 people and with the stock’s market cap sitting at USD $1.87B, it comes under the small-cap group.

GES has a nice dividend yield of 3.95% and the company currently pays out -854.36% of its profits as dividends , with analysts expecting a 63.09% payout in the next three years. GES’s dividends have seen an increase over the past 10 years, with payments increasing from US$0.32 to US$0.90 in that time. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. Over the past 12 months, GES’s ROE of -0.42% outperformed the US Specialty Retail industry, which averaged a 12.93% return. Interested in Guess’? Find out more here.

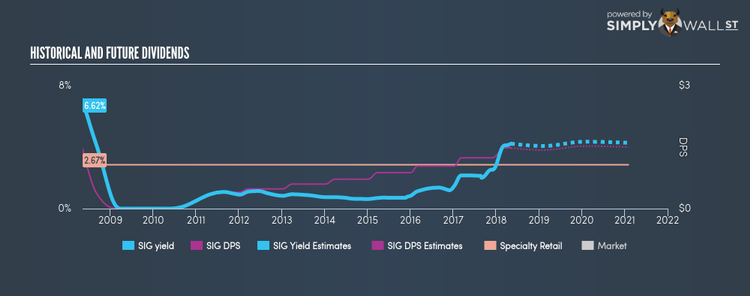

Signet Jewelers Limited (NYSE:SIG)

Signet Jewelers Limited engages in the retail sale of diamond jewelry, watches, and other products in the United States, Canada, the United Kingdom, the Republic of Ireland, and the Channel Islands. Founded in 1950, and currently lead by Virginia Drosos, the company currently employs 24,888 people and has a market cap of USD $2.24B, putting it in the mid-cap category.

SIG has a good-sized dividend yield of 3.96% and their payout ratio stands at 16.06% , with analysts expecting the payout ratio in three years to be 40.40%. Although investors would have seen a few years of reduced payments, it has picked up again, with dividends increasing from US$1.46 to US$1.48 over the past 10 years. Signet Jewelers is also reasonably priced, with a PE ratio of 4.8 that compares favorably with the US Specialty Retail average of 19.2. More on Signet Jewelers here.

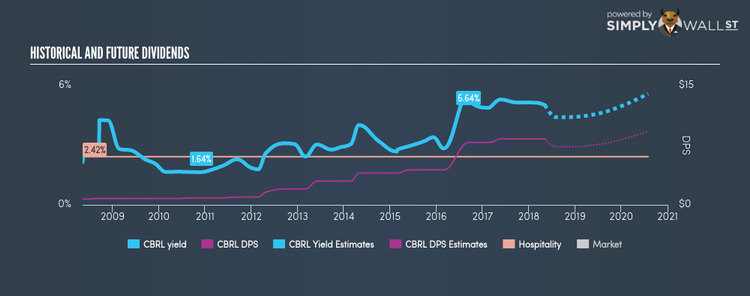

Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL)

Cracker Barrel Old Country Store, Inc. develops and operates the Cracker Barrel Old Country Store concept in the United States. Founded in 1969, and run by CEO Sandra Cochran, the company employs 73,000 people and with the market cap of USD $3.97B, it falls under the mid-cap stocks category.

CBRL has a sumptuous dividend yield of 5.02% and their current payout ratio is 47.89% , with an expected payout of 84.04% in three years. CBRL’s last dividend payment was US$8.30, up from it’s payment 10 years ago of US$0.72. It should comfort existing and potential future shareholders to know that CBRL hasn’t missed a payment during this time. Interested in Cracker Barrel Old Country Store? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.