Mettler-Toledo (MTD) Q4 Earnings & Sales Beat, Increase Y/Y

Mettler-Toledo International, Inc. MTD reported fourth-quarter 2022 adjusted earnings of $12.10 per share, which beat the Zacks Consensus Estimate by 4.04%. The bottom line also improved by 15% on a year-over-year basis.

Net sales of $1.06 billion were up 2% on a reported basis and 9% on a currency-neutral basis from the year-ago quarter’s respective readings. The figure surpassed the Zacks Consensus Estimate of $1.03 billion.

Solid momentum across the Laboratory, Industrial and Food Retail segments in the reported quarter drove the top line. The strong performance delivered across the Americas, Europe and Asia/Rest of the World contributed well.

We believe portfolio strength, cost-cutting efforts, margin and productivity initiatives and robust sales and marketing strategies are expected to remain tailwinds for the company.

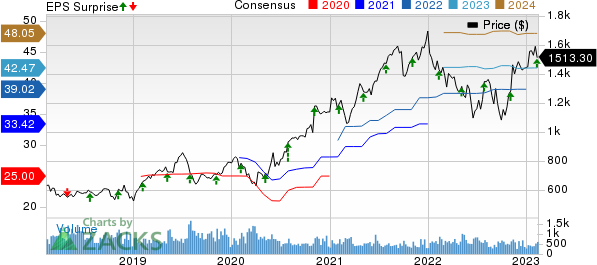

Mettler-Toledo International, Inc. Price, Consensus and EPS Surprise

Mettler-Toledo International, Inc. price-consensus-eps-surprise-chart | Mettler-Toledo International, Inc. Quote

Top Line in Detail

By Segments: MTD reports revenues under three segments, namely Laboratory Instruments, Industrial Instruments and Food Retail, which accounted for 58%, 38% and 4% of net sales in the fourth quarter, respectively. The Laboratory, Industrial and Food Retail segments witnessed year-over-year improvements of 10%, 6% and 12%, respectively, in the quarter under review.

By Geography: Total sales from the Americas, Europe and Asia/Rest of the World contributed 40%, 28% and 32% to net sales in the fourth quarter, respectively. Sales in the Americas, Europe and Asia/Rest of the World went up 8%, 9% and 9%, respectively, on a year-over-year basis.

Operating Results

The gross margin was 59.8%, expanding 130 basis points (bps) year over year.

Research & development (R&D) expenses were $45.9 million, up 0.7% from the year-ago quarter’s tally. Selling, general & administrative (SG&A) expenses decreased 6.1% year over year to $227.6 million.

As a percentage of sales, R&D expenses contracted by 10 bps year over year to 4.3%. SG&A expenses contracted 190 bps year over year to 21.5%.

The adjusted operating margin was 33.9%, which expanded 310 bps from the prior-year quarter’s level.

Balance Sheet & Cash Flow

As of Dec 31, 2022, Mettler-Toledo’s cash and cash equivalent balance was $95.97 million, down from $122.1 million as of Sep 30, 2022.

Long-term debt was $1.908 billion at the end of the fourth quarter compared with $1.825 billion at the end of the third quarter.

Mettler-Toledo generated $303.6 million in cash from operating activities in the reported quarter, up from $245.4 million in the previous quarter. Free cash flow was $272.8 million in the reported quarter.

Guidance

For first-quarter 2023, Mettler-Toledo projects sales growth of 6% in local currency from the year-ago quarter’s reported figure.

Adjusted first-quarter earnings are anticipated to be $8.55-$8.65 per share, implying a 9-10% rise from the year-ago quarter’s reported number, which includes a foreign-currency headwind of 6%. The Zacks Consensus Estimate for earnings is pegged at $8.58 per share.

For 2023, Mettler-Toledo expects sales growth in local currency of 5% from the year-earlier tally.

Mettler-Toledo anticipates 2023 adjusted earnings within $43.55-$43.95 per share, suggesting growth of 10-11% from the year-ago reported number. The Zacks Consensus Estimate for the same is pegged at $42.47.

Zacks Rank & Other Stocks to Consider

Currently, Mettler-Toledo has a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader Zacks Computer & Technology sector are Agilent Technologies A, Arista Networks ANET and Garmin GRMN, all of which carry the same rank as Mettler-Toledo at present. You can see the complete list of today’s Zacks #1 Rank stocks here

Agilent has gained 8.4% in the past year. A’s long-term earnings growth rate is currently projected at 10%.

Arista Networks has gained 6.1% in the past year. The long-term earnings growth rate for ANET is currently projected at 17.5%.

Garmin has lost 24.6% in the past year. The long-term earnings growth rate for GRMN is currently projected at 5.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Mettler-Toledo International, Inc. (MTD) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report