Microchip (MCHP) Q2 Earnings Top Estimates, Sales Rise Y/Y

Microchip Technology MCHP reported second-quarter fiscal 2023 non-GAAP earnings of $1.46 per share, which beat the Zacks Consensus Estimate by 1.39% and rose 36.4% on a year-over-year basis.

Net sales of $2.07 billion increased 25.7% year over year and surpassed the Zacks Consensus Estimate by 0.52%.

Quarter in Detail

In terms of product line, microcontroller sales grew 31.9% year over year and 11% sequentially to $1.06 billion, accounting for 57% of revenues.

Analog net sales of $580 million decreased 1.3% sequentially but increased 16.6% year over year. Analog contributed 28% to the total revenues.

Other revenues of $320.6 million accounted for 15% of revenues.

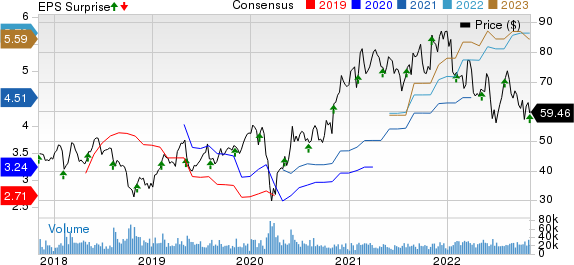

Microchip Technology Incorporated Price, Consensus and EPS Surprise

Microchip Technology Incorporated price-consensus-eps-surprise-chart | Microchip Technology Incorporated Quote

Geographically, revenues from the Americas, Europe and Asia contributed 25%, 20% and 55% to net sales, respectively.

The non-GAAP gross margin expanded 240 basis points (bps) on a year-over-year basis to 67.7%, primarily benefiting from a favorable product mix.

Non-GAAP research & development expenses, as a percentage of net sales, declined 130 bps year over year to 12%. Non-GAAP selling, general & administrative (SG&A) expenses, as a percentage of net sales, declined 60 bps to 8.9%.

Non-GAAP operating expenses, as a percentage of net sales, declined 190 bps year over year to 20.9%.

Consequently, the non-GAAP operating margin expanded 440 bps on a year-over-year basis to 46.9%.

Balance Sheet & Cash Flow

As of Sep 30, 2022, cash and short-term investments totaled $306.8 million compared with $379.1 million as of Jun 30, 2022.

As of Sep 30, 2022, its total debt (long-term plus current portion) was $7.30 billion. The company paid down $264.9 million of debt in the reported quarter.

For the fiscal second quarter, cash flow from operating activities was $793.2 million compared with $840.4 million in the previous quarter.

Free cash flow was $682.9 million in the reported quarter.

Microchip announced a quarterly dividend of 32.8 cents per share, up 9% sequentially and 41.4% from the year-ago quarter.

Guidance

Microchip expects net sales of $2.135-$2.177 billion for third-quarter fiscal 2023, indicating 3-5% sequential growth. At the mid-point of the guidance, net sales are expected to grow 22.7% year over year.

Non-GAAP earnings are anticipated between $1.54 per share and $1.56 per share.

Non-GAAP gross margin is anticipated between 67.8% and 68%.

Non-GAAP operating expenses are projected to be 20.7-20.9%.

Non-GAAP operating margin is anticipated to be 46.9-47.3%.

Capital expenditure for the fiscal third quarter is expected between $105 million and $125 million. Capital expenditure for fiscal 2023 is estimated between $500 million and $550 million.

Zacks Rank & Stocks to Consider

Microchip currently carries a Zacks Rank #4 (Sell).

Asure Software ASUR, Absolute Software ABST, and Agilent Technologies A are some better-ranked stocks that investors can consider in the broader sector. All three stocks have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Asure shares are down 15% year to date. ASUR is set to report third-quarter 2022 results on Nov 7.

Absolute shares are up 19.9% year to date. ABST is set to report first-quarter fiscal 2023 results on Nov 8.

Agilent shares are down 15.7% year to date. A is set to report fourth-quarter fiscal 2022 results on Nov 21.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Absolute Software Corporation (ABST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research