Middleby (MIDD) Q2 Earnings Beat, Revenues Surge 25% Y/Y

The Middleby Corporation MIDD reported second-quarter 2022 adjusted earnings (excluding 16 cents from non-recurring items) of $2.23 per share, which beat the Zacks Consensus Estimate of $2.16. The bottom line increased 6% year over year on higher sales.

Net sales of $1013.6 million surpassed the Zacks Consensus Estimate of $997.8 million. The top line jumped 25.3% year over year. Organic revenues in the reported quarter increased 13.3% year over year on the back of higher shipments. Acquired assets boosted sales by 14.4%, while movements in foreign currencies had a negative impact of 2.5%.

Segmental Results

Sales from the Commercial Foodservice Equipment Group (representing 60.1% of the net sales) were $609.68 million, up 19.8% year over year. Organic sales in the reported quarter increased 17.7%. Buyouts boosted sales by 4%, while movements in foreign currencies had a headwind of 1.9%.

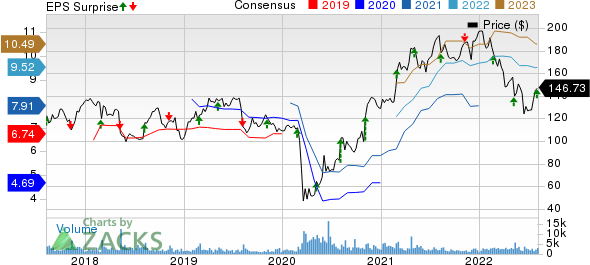

The Middleby Corporation Price, Consensus and EPS Surprise

The Middleby Corporation price-consensus-eps-surprise-chart | The Middleby Corporation Quote

Sales from the Residential Kitchen Equipment Group (representing 27.6% of the reported quarter’s net sales) totaled $280 million, up 64.7% year over year. Organic sales in the quarter under review increased 11.4%. Buyouts had a positive impact of 56.8%, whereas movements in foreign currencies had a negative impact of 3.5%.

Sales from the Food Processing Equipment Group (representing 12.2% of the reported net sales) summed $123.9 million, down 4.7% year over year. Organic sales in the quarter dipped 1.4%, while movements in foreign currencies had a negative impact of 3.4%.

Margin Profile

In the second quarter, Middleby’s cost of sales increased 29.3% year over year to $652.86 million. Gross profit expanded 18.8% to $360.74 million. Gross margin decreased to 35.6% from 37.6% in the year-ago quarter.

Selling, general and administrative expenses increased 14.3% year over year to $189.49 million. Operating income in the second quarter increased 22.3% year over year to $167.23 million. Operating margin decreased to 16.5% from 16.9% in the year-ago period.

Balance Sheet and Cash Flow

Exiting the second quarter, Middleby had cash and cash equivalents of $166.59 million compared with $180.36 million at the end of December 2021. Long-term debt was $2.65 billion at the end of the second quarter compared with $2.39 billion at the end of 2021.

In the first six months of 2022, MIDD generated net cash of $89.46 million compared with $172.38 million at the end of the year-ago period. Capital expenditure (net of sale proceeds) totaled $32.13 million compared with $13.36 million at the end of the first half of 2021. Free cash flow was $57.33 million, down 64% from the year-ago period.

Zacks Rank & Key Picks

Middleby carries a Zacks Rank #3 (Hold). Some better-ranked stocks within the broader Industrial Products sector are as follows:

Greif, Inc. GEF presently sports a Zacks Rank #1 (Strong Buy). GEF delivered a trailing four-quarter earnings surprise of 22.9%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Greif has an estimated earnings growth rate of 36.8% for the current year. Shares of the company have gained 18% in the past six months.

Titan International, Inc. TWI presently flaunts a Zacks Rank of 1. Its earnings surprise in the last four quarters was 47%, on average.

Titan International has an estimated earnings growth rate of 157.7% for the current year. Shares of the company have rallied 40% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Middleby Corporation (MIDD) : Free Stock Analysis Report

Titan International, Inc. (TWI) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.