Middleby: Will Minimum Wages Fuel Growth?

- By Robert Abbott

One of the key axioms of economics is that if you charge more for something, you get less of it. Therefore, with recent impositions of minimum wage hikes in many jurisdictions, we would expect fewer hours of labor at companies that employ low-income staff. Prominent among low-income employers are food service companies.

Yet the work still must be done. Employers can try to get more productivity out of the labor they have, tweak their costs in other areas, and in some areas increase prices. However, the food services industry has many players, and price increases could reduce market share.

Warning! GuruFocus has detected 5 Warning Sign with MIDD. Click here to check it out.

The intrinsic value of MIDD

So, what is to be done? One of the few available solutions is adoption of automated equipment that provides the same service as low-paid staff. In most cases, this involves substituting capital expenditures for operating expenses. It is not quite that simple, of course, but it is bound to be a factor of growing importance.

In the case of fast food restaurants, automation can take place in the front-end or the back-end. The most familiar front-end technology involves kiosks at which customers place and pay for their orders, rather than giving them verbally to human staff.

In the back-end, technology takes the form of equipment that prepares food, in whole or in part. Middleby Corp. (MIDD) is a food service equipment company that stands to benefit where minimum wages have jumped.

"We have more and more chains coming to us looking at how to resolve labor issue, how do we offset the higher cost of labor through automation," CEO Selim Bassoul said during a conference call in May 2017.

Middleby Corp. is an $8.37 billion industrial products company. Based in the U.S., it operates through Middleby Marshall Inc. and other subsidiaries, to design, manufacture and market food service equipment.

I profiled it in late 2014, when it was a Buffett-Munger Screener stock. Currently, it is on the Undervalued Predictable list, but not on Buffett-Munger (for historical and other information about Middleby, see the article here).

GuruFocus gives it a 4-Star (out of 5) rating, along with a 6/10 for financial strength and a 9/10 for Profitability & Growth.

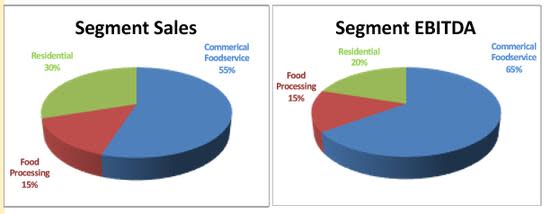

But what about growth driven by the recent push for $15 an hour minimum wage? First, it's necessary to recognize Middleby has three main business segments:

Commercial Foodservice Equipment Group.

Food Processing Equipment Group.

Residential Kitchen Equipment Group.

As these charts from a company presentation in June 2017 show, Commercial Foodservice is the biggest segment:

Automation is named as a growth driver in this slide from the presentation:

Automation is also high on the list when it comes to what the company describes as "ongoing growth in commercial food through innovation."

So minimum wage hikes could figure significantly in Middleby's ongoing growth. At the same time, though, this is a big company, and only one division is directly affected. Further, automation comes with a high, up-front price tag as compared with human labor that can be purchased on the equivalent of a pay-as-you-go system.

There are other factors more likely to affect the top and bottom lines: internal innovation and an aggressive acquisition strategy.

Because the company serves the food industry, its customers operate under constant price pressure, and expect suppliers like Middleby to keep them competitive or even to gain an edge. In its 10-K for 2016, the company notes, "The product, program and service needs of the company's customers change and evolve regularly, and the company invests substantial amounts in research and development efforts to pursue advancements in a wide range of technologies, products and services." In addition to developing new products, it also is constantly refining and improving the price/performance attributes of its existing products. No doubt automation is currently an important part of that innovation mix.

The acquisition strategy operates in a space that the company calls highly competitive and fragmented. It lists its major competitors to its Commercial Foodservice segment as: Manitowoc Company Inc. (MTW); Vulcan-Hart and Hobart Corporation, subsidiaries of Illinois Tool Works Inc. (ITW); Electrolux (ELUX.A); Groen, a subsidiary of Dover Corporation (DOV); Rational AG (RAA); and the Ali Group.

The company has a long-standing, effective and aggressive acquisition strategy at the core of its business model. In a 2013 interview with The Motley Fool, CEO Bassoul explained that Middleby never acquires to grow market size or to buy into a market. That has allowed the company's acquisitions to be generally value-added, unlike many acquisitions and mergers.

In choosing companies to target, Bassoul said it is often told by customers that a competitor does something better than Middleby does in the same space. He said they look for two elements when they shop for acquisitions:

Targets have a respected brand, as well as patented technology that is already disrupting the market (and something Middleby would not be able to develop on its own in many years).

Second, they look for the ability to buy the company and keep its management team (he says they never fire acquired management teams). That management, plus capital and "DNA" provided by Middleby, should allow the bought company to be accretive in less than 18 months and provide a price multiple of five times after integration. One scenario is to help smaller domestic companies expand internationally in five or fewer years.

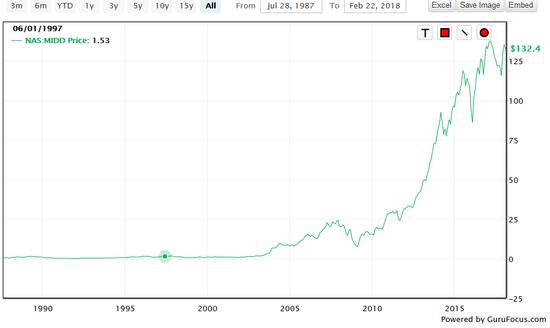

How has the innovation/acquisition strategy worked for Middleby? Let's start with a price chart (by way of reference, Bassoul took over the company in 2000; on Jan. 1 of that year, the stock price was $1.06 -- it closed at $132.96 on Feb. 22, 2018):

The current share price is more than 125-times greater than it on January 1, 2000.

The price chart reflects the fundamentals of Middleby's growth, with revenue (blue line) and earnings per share (red line) growing in tandem with the share price (green line):

Generally, the financial metrics are solid:

Operating margin: 20.35%

Net margin: 13.21%

ROE: 22.76%

ROA: 10.05%

P/E Ratio: 24.99

PEG Ratio: 1.16

Interest coverage: 25.49

DCF Fair Value: $138.97

Margin of Safety: 4%

The P/E in an absolute sense is high at 25, but in a relative sense, not overly expensive for a stock with this much ongoing growth.

The company's management gets a thumbs-up from Ron Baron (Trades, Portfolio) of Baron Mutual Funds, who said in 2016, "Middleby has been led by Selim Bassoul, a passionate manager with a highly regarded leadership style who is widely credited with turning the company around."

Baron is one of four gurus invested in Middleby. The other three are: Columbia Wanger (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio). Baron is the largest holder among them, with 814,362 shares.

Conclusions

Middleby Corp. should enjoy additional growth because $15 an hour minimum wage rates appear to be spreading and sticking. The company's CEO agrees with that proposition, and notes that this trend is customer-driven, since food service companies, including fast food, are under pressure to keep costs under control.

Acquisitions appear to offer even more upside potential. The company is not buying for ego reasons but for strategic reasons. With dozens of buys in the past two decades, the company has acquired expertise in finding targets that help it serve its customers more effectively.

Middleby takes a value perspective in its acquisitions, ensuring they have robust and patented technologies that are also disruptive and provide moats (great companies). Note, too, that it has a sharp set of expectations that should prevent it from overpaying for acquisitions (great prices).

Finally, the company does meet some value criteria for investors, given its Undervalued Predictable status at GuruFocus. The price chart shows the stock has taken a couple of sharp, quick corrections in the recent past; the 13% drop this past November would have driven up the margin of safety, and perhaps made it a buy. It is a stock worth watching.

Disclosure: I do not own shares in any of the companies listed and do not expect to buy any in the next 72 hours.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Sign with MIDD. Click here to check it out.

The intrinsic value of MIDD