Moderna (MRNA) to Report Q3 Earnings: What's in the Cards?

Moderna MRNA will report third-quarter 2022 results on Nov 3, before market open. In the last reported quarter, the company delivered an earnings surprise of 16.44%.

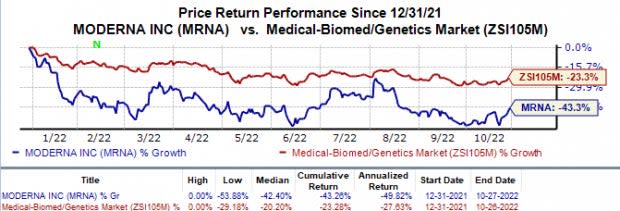

Moderna’s shares have plunged 43.3% so far this year compared with the industry’s decline of 23.3%.

Image Source: Zacks Investment Research

The company’s surprise history has been mixed, with earnings beating estimates in three of the trailing four quarters while missing the same once. The average surprise is 20.72%.

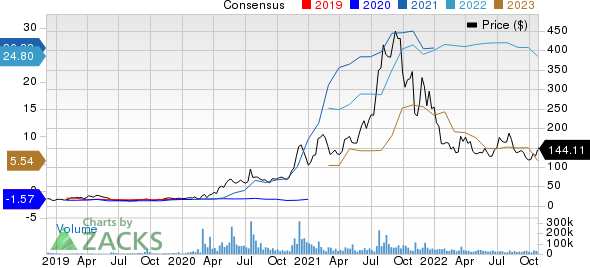

Moderna, Inc. Price and Consensus

Moderna, Inc. price-consensus-chart | Moderna, Inc. Quote

Let’s see how things have shaped up for this announcement.

Factors to Note

For the third quarter, Moderna’s sales are likely to have been driven by its mRNA-based COVID-19 monovalent and bivalent vaccine doses across the globe. As the impact of the pandemic continues to subside in the United States and the government is encouraging citizens to resume pre-pandemic activities, Moderna is focused on developing its non-COVID pipeline to reduce its dependence on a single target market for revenues.

The Zacks Consensus Estimate for third-quarter product sales stands at $3.6 billion. This projected figure indicates a decline from second-quarter 2022 revenues of $4.5 billion.

Earlier this August, Moderna received emergency use authorization (EUA) from the FDA for its BA.4/.5 Omicron-targeting bivalent COVID-19 booster vaccine, mRNA-1273.222, in adults. A regulatory filing seeking authorization for mRNA-1273.222 is already under review in Europe. During the quarter, Moderna also received authorization for the use of mRNA-1273.214, another bivalent vaccine targeting the BA.1 Omicron subvariant, in Australia, Canada and Europe.

Management has already entered into new supply agreements or revised existing supply agreements with these countries to supply Moderna’s bivalent COVID vaccines. While Moderna has an agreement to supply up to 300 million doses of mRNA-1273.222 in exchange for a consideration of up to $1.74 billion, it has revised the supply terms with the European countries for supplying its bivalent vaccines.

Moderna’s grant revenues in the third quarter are likely to have been driven by an award from the Biomedical Advanced Research and Development Authority (BARDA) under the agreement to develop its coronavirus vaccine programs. The Zacks Consensus Estimate for grant revenues is pegged at $80 million.

Apart from its COVID-19 vaccine candidates, Moderna is developing more than 30 candidates in different stages of clinical studies, majorly mRNA-based products targeting different indications, including cancer.

Moderna is also developing a few pipeline candidates in collaboration with partners like AstraZeneca and Merck MRK, which use its mRNA technology to develop therapies targeting different indications. The partners pay milestone payments to Moderna, which are reflected as collaboration revenues. These collaboration revenues vary every quarter. The Zacks Consensus Estimate for collaboration revenues in the third quarter is pegged at $32.16 million.

Earlier this month, partner Merck exercised an option under an existing collaboration agreement. Per the agreement, the companies will develop and commercialize Moderna’s personalized cancer vaccine (PCV) candidate, mRNA-4157/V940. In consideration for exercising the option, Merck will pay $250 million to Moderna. This payment will be made by Merck in third-quarter 2022 and included in its non-GAAP financial results. Per the terms of collaboration, the companies will share costs and profits equally.

Moderna may also discuss the progress on the development of its three mRNA-based vaccines targeting cytomegalovirus (CMV), influenza and respiratory syncytial virus (RSV) vaccine. While these vaccine candidates are currently in late-stage development, we also expect the company to provide an update on its other pipeline candidates.

Earnings Whispers

Our proven model does not predict an earnings beat for Moderna this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Moderna has an Earnings ESP of -17.91% as the Most Accurate Estimate of $2.48 per share is lower than the Zacks Consensus Estimate of $3.02.

Zacks Rank: Moderna has a Zacks Rank #3, currently.

Stocks to Consider

Here are a few stocks worth considering from the healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Angion Biomedica ANGN has an Earnings ESP of +25.00% and a Zacks Rank #1. You can the complete list of today’s Zacks #1 Rank stocks here.

Angion Biomedica’s stock has plunged 65.7% this year so far. ANGN beat earnings estimates in three of the last four quarters while missing the mark on one occasion. Angion Biomedica has delivered an earnings surprise of 62.85%, on average.

Hookipa Pharma HOOK has an Earnings ESP of +8.33% and a Zacks Rank #1.

Hookipa Pharma’s stock has plunged 47.6% this year so far. Hookipa missed earnings estimates in three of the last four quarters while beating the mark on one occasion. Hookipa Pharma has delivered a negative earnings surprise of 58.21%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

Angion Biomedica Corp. (ANGN) : Free Stock Analysis Report

HOOKIPA Pharma Inc. (HOOK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research