Mosaic Stock Pulls Back After Fertilizer Cuts

The shares of Fortune 500 name Mosaic Co (NYSE:MOS) are slipping today, following yesterday's one-month closing high of $20.86. The dip comes after Mosaic said it will reduce its fertilizer production, blaming weak market conditions and a problematic harvest in the U.S., which has dampened demand for the product. At last glance, the stock is down 1.6%, to trade at $20.54.

The options pits have been quite active as a result. So far, 18,000 calls and 9,620 puts have crossed the tape -- 11 times what's typically seen at this point. The March 23 call is the most popular, with contracts being bought to open here, suggesting these traders are speculating on a turnaround for MOS by the time the contracts expire on Friday, March 20. The weekly 1/31 17-strike put is also getting a lot of attention, with contracts being sold to open here as well.

In recent weeks however, options bulls have ruled the roost. In fact, during the last 10 days at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) 4.66 calls were picked up for every put. This ratio sits higher than 73% of all other readings from the past year, indicating that this preference is unusual.

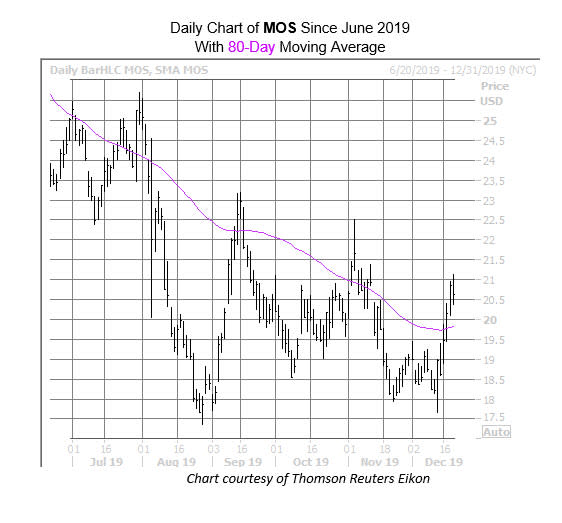

It's worth noting that MOS just broke through long-term resistance at its 80-day moving average, too. According to a study from Schaeffer's Senior Quantitative Analyst Rocky White, MOS has seen nine similar run ups to this trendline in the last three years. This study shows that 75% of the time, Mosaic was lower one month after each signal, averaging a 6.15% drop. Mosaic is still trading well above its 80-day, but this signal may still have time to play out considering today's pullback.

That being said, for those wanting to speculate on MOS stock's next move, options might be a good idea. The security's Schaeffer's Volatility Index (SVI) of 34% sits in the relatively low 27th percentile of its annual range, indicating that options players are pricing in volatility expectations lower than 27% of all other readings from the past year. Plus, Mosaic's Schaeffer's Volatility Scorecard (SVS) sits at 83, suggesting the stock has tended to exceed options traders' volatility expectations during the past year.