Most Shareholders Will Probably Find That The Compensation For Rightmove plc's (LON:RMV) CEO Is Reasonable

Shareholders may be wondering what CEO Peter Brooks-Johnson plans to do to improve the less than great performance at Rightmove plc (LON:RMV) recently. At the next AGM coming up on 07 May 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for Rightmove

How Does Total Compensation For Peter Brooks-Johnson Compare With Other Companies In The Industry?

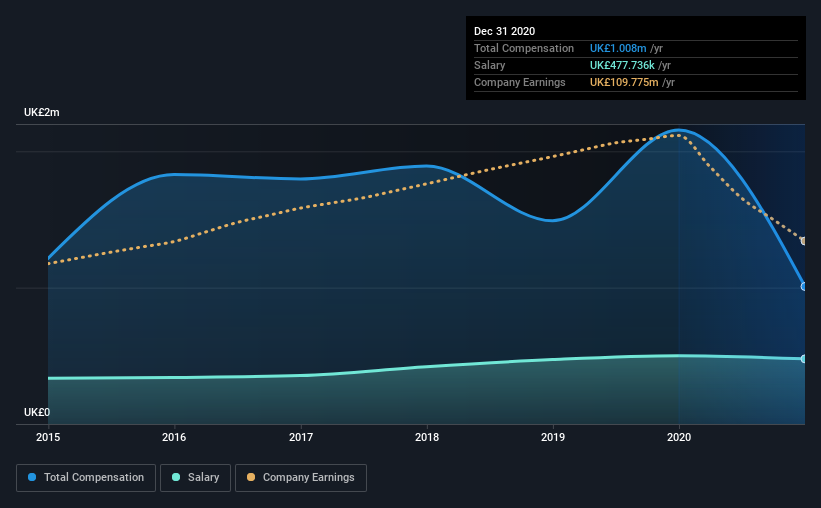

Our data indicates that Rightmove plc has a market capitalization of UK£5.3b, and total annual CEO compensation was reported as UK£1.0m for the year to December 2020. That's a notable decrease of 53% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at UK£478k.

For comparison, other companies in the same industry with market capitalizations ranging between UK£2.9b and UK£8.6b had a median total CEO compensation of UK£2.2m. In other words, Rightmove pays its CEO lower than the industry median. Moreover, Peter Brooks-Johnson also holds UK£12m worth of Rightmove stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2020 | 2019 | Proportion (2020) |

Salary | UK£478k | UK£501k | 47% |

Other | UK£531k | UK£1.7m | 53% |

Total Compensation | UK£1.0m | UK£2.2m | 100% |

On an industry level, roughly 47% of total compensation represents salary and 53% is other remuneration. Rightmove is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Rightmove plc's Growth

Over the last three years, Rightmove plc has shrunk its earnings per share by 7.0% per year. Its revenue is down 29% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Rightmove plc Been A Good Investment?

We think that the total shareholder return of 38%, over three years, would leave most Rightmove plc shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Rightmove that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.