What You Must Know About Bellway plc’s (LSE:BWY) Financial Health

Mid-caps stocks, like Bellway plc (LSE:BWY) with a market capitalization of GBP £4.24B, aren’t the focus of most investors who prefer to direct their investments towards either large-cap or small-cap stocks. While they are less talked about as an investment category, mid-cap risk-adjusted returns have generally been better than more commonly focused stocks that fall into the small- or large-cap categories. I’ve put together a small checklist, which I believe provides a ballpark estimate of their financial health status. View our latest analysis for Bellway

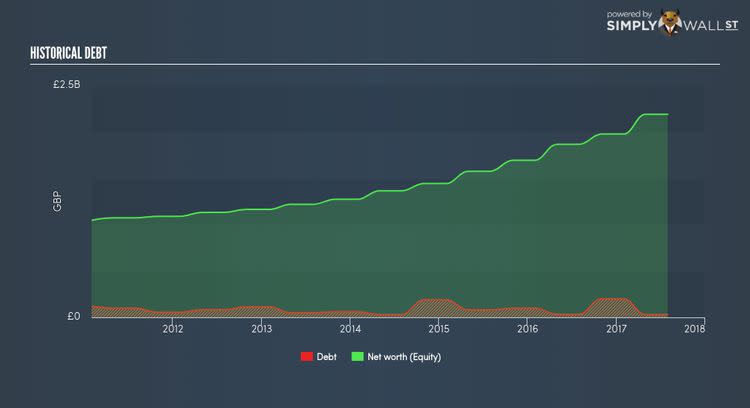

Is BWY’s level of debt at an acceptable level?

While ideally the debt-to equity ratio of a financially healthy company should be less than 40%, several factors such as industry life-cycle and economic conditions can result in a company raising a significant amount of debt. In the case of BWY, the debt-to-equity ratio is 1.37%, which indicates that the company faces low risk associated with debt. While debt-to-equity ratio has several factors at play, an easier way to check whether BWY’s leverage is at a sustainable level is to check its ability to service the debt. A company generating earnings at least three times its interest payments is considered financially sound. BWY’s profits amply covers interest at 51.68 times, which is seen as relatively safe. Lenders may be less hesitant to lend out more funding as BWY’s high interest coverage is seen as responsible and safe practice.

Can BWY meet its short-term obligations with the cash in hand?

A different measure of financial health is measured by its short-term obligations, which is known as liquidity. These include payments to suppliers, employees and other stakeholders. If an adverse event occurs, the company may be forced to pay these immediate expenses with its liquid assets. To assess this, I compare BWY’s cash and other liquid assets against its upcoming debt. Our analysis shows that BWY does have enough liquid assets on hand to meet its upcoming liabilities, which lowers our concerns should adverse events arise.

Next Steps:

Are you a shareholder? BWY’s high cash coverage and low levels of debt indicate its ability to use its borrowings efficiently in order to produce a healthy cash flow. Since BWY’s capital structure could change over time, You should continue examining market expectations for BWY’s future growth on our free analysis platform.

Are you a potential investor? Although understanding the serviceability of debt is important when evaluating which companies are viable investments, it shouldn’t be the deciding factor. Ultimately, debt is often used to fund or accelerate new projects that are expected to improve a company’s growth trajectory in the longer term. BWY’s Return on Capital Employed (ROCE) in order to see management’s track record at deploying funds in high-returning projects.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.