What You Must Know About DXStormcom Inc’s (CVE:DXX) Financial Health

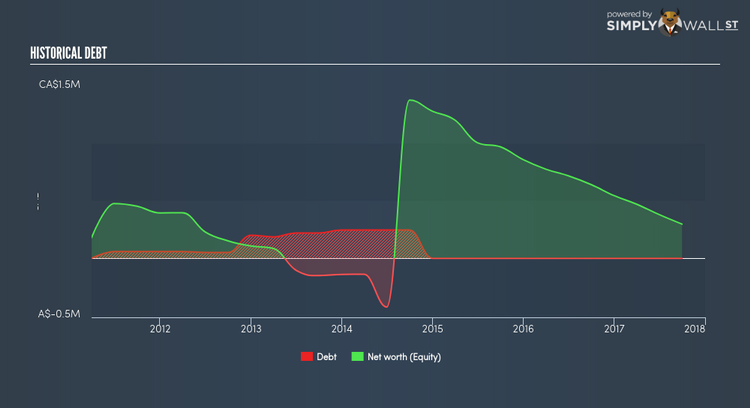

DXStormcom Inc (TSXV:DXX), which has zero-debt on its balance sheet, can maximize capital returns by increasing debt due to its lower cost of capital. However, the trade-off is DXX will have to follow strict debt obligations which will reduce its financial flexibility. Zero-debt can alleviate some risk associated with the company meeting debt obligations, but this doesn’t automatically mean DXX has outstanding financial strength. I will take you through a few basic checks to assess the financial health of companies with no debt. View our latest analysis for DXStorm.com

Is DXX growing fast enough to value financial flexibility over lower cost of capital?

There are well-known benefits of including debt in capital structure, primarily a lower cost of capital. Though, the trade-offs are that lenders require stricter capital management requirements, in addition to having a higher claim on company assets relative to shareholders. DXX’s absence of debt on its balance sheet may be due to lack of access to cheaper capital, or it may simply believe low cost is not worth sacrificing financial flexibility. However, choosing flexibility over capital returns is logical only if it’s a high-growth company. Opposite to the high growth we were expecting, DXX’s negative revenue growth of -10.30% hardly justifies opting for zero-debt. If the decline sustains, it may find it hard to raise debt at an acceptable cost.

Does DXX’s liquid assets cover its short-term commitments?

Since DXStorm.com doesn’t have any debt on its balance sheet, it doesn’t have any solvency issues, which is a term used to describe the company’s ability to meet its long-term obligations. But another important aspect of financial health is liquidity: the company’s ability to meet short-term obligations, including payments to suppliers and employees. Looking at DXX’s most recent CA$0.1M liabilities, it appears that the company has been able to meet these commitments with a current assets level of CA$0.5M, leading to a 4.7x current account ratio. Though, anything about 3x may be excessive, since DXX may be leaving too much capital in low-earning investments.

Next Steps:

Are you a shareholder? Given that DXStorm.com is a relatively low-growth company, being in a zero-debt position isn’t always optimal. As shareholders, you should try and determine whether this strategy is justified for DXX, and why financial flexibility is needed at this stage in its business cycle. I suggest you take a look into a future growth analysis to properly assess what the market expects for the company moving forward.

Are you a potential investor? In terms of meeting is short term obligations, there’s nothing to worry about for DXX. Though, its soft revenue growth could hurt returns, meaning there is some benefit to looking at low-cost funding alternatives. Keep in mind I haven’t considered other factors such as how DXX has been performing in the past. You should continue your analysis by taking a look at DXX’s past performance to figure out DXX’s financial health position.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.