NasdaqGM Service Industry: A Deep Dive Into Estre Ambiental Inc (NASDAQ:ESTR)

Estre Ambiental Inc (NASDAQ:ESTR), a $449.03M small-cap, operates in the commercial services industry, which is faced with evolving conditions and potential further consolidation to gain market share. Commercial services analysts are forecasting for the entire industry, a positive double-digit growth of 10.45% in the upcoming year . Today, I will analyse the industry outlook, as well as evaluate whether Estre Ambiental is lagging or leading in the industry. See our latest analysis for Estre Ambiental

What’s the catalyst for Estre Ambiental’s sector growth?

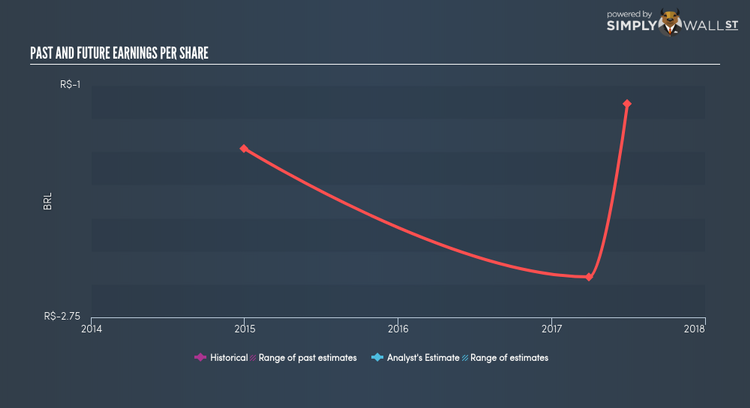

A main driver of the industry has been the growing relevance of e-commerce for commercial services, enabling companies to reduce cost to serve while growing market presence at the same time. More than ever, it is crucial for the incumbents to position itself to respond to the growing relevance of stock-less independent dealers, further service pure e-commerce players and also build on their own e-commerce capabilities. In the past year, the industry delivered growth of 6.67%, though still underperforming the wider US stock market. Estre Ambiental lags the pack with its sustained negative earnings over the past couple of years. The company’s outlook seems uncertain, with a lack of analyst coverage, which doesn’t boost our confidence in the stock. This lack of growth and transparency means Estre Ambiental may be trading cheaper than its peers.

Is Estre Ambiental and the sector relatively cheap?

Commercial services companies are typically trading at a PE of 20x, in-line with the US stock market PE of 20x. This means the industry, on average, is fairly valued compared to the wider market – minimal expected gains and losses from mispricing here. Furthermore, the industry returned a similar 12.42% on equities compared to the market’s 10.47%. Since Estre Ambiental’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge Estre Ambiental’s value is to assume the stock should be relatively in-line with its industry.

Next Steps:

Estre Ambiental recently delivered an industry-beating growth rate in earnings, which is a positive for shareholders. If the stock has been on your watchlist for a while, now may be the time to buy, if you like its ability to deliver growth and are not highly concentrated in the services industry. However, before you make a decision on the stock, I suggest you look at Estre Ambiental’s fundamentals in order to build a holistic investment thesis.

1. Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

2. Historical Track Record: What has ESTR’s performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

3. Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Estre Ambiental? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.