NETGEAR's (NTGR) Q4 Earnings Beat Estimates, Revenues Miss

NETGEAR, Inc. NTGR reported tepid fourth-quarter 2021 results, with both the earnings and revenues declining on a year-over-year basis. The bottom line beat the Zacks Consensus Estimate but the top line missed the same.

Lowered first-quarter outlook due to persistent supply chain woes in the face of the pandemic is expected to hamper the top line of both Connected Home Products (CHP) and Small and Medium Business (SMB) units.

Despite such a challenging situation, NETGEAR continues to witness a solid demand environment for its avant-garde Wi-Fi 6 offerings. Moreover, increased penetration into the premium segment of the market, along with an accretive subscriber base and continued market share gains in the U.S. Retail Wi-Fi market, is a significant tailwind.

Bottom Line

On a GAAP basis, net loss in the quarter was $1 million or a loss of 3 cents per share against net income of $30.9 million or 99 cents per share in the year-ago quarter. The drastic deterioration was mainly due to year-over-year top-line contraction and lower operating income.

Quarterly non-GAAP net income was $8.1 million or 27 cents per share compared with $31 million or 99 cents per share in the year-earlier quarter. The bottom line surpassed the Zacks Consensus Estimate by 12 cents.

In 2021, GAAP net income came in at $49.4 million or $1.59 per share compared with $58.3 million or $1.90 per share in 2020. Non-GAAP net income for the year was $75.8 million or $2.44 per share compared with $88.3 million or $2.88 per share in 2020.

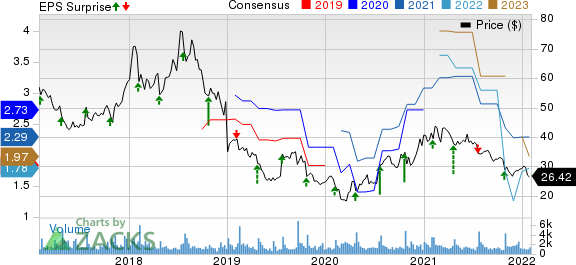

NETGEAR, Inc. Price, Consensus and EPS Surprise

NETGEAR, Inc. price-consensus-eps-surprise-chart | NETGEAR, Inc. Quote

Revenues

NETGEAR generated net revenues of $251.2 million, down 31.6% year over year. The downtick was mainly due to weakness in the CHP segment. The company witnessed a stabilized U.S. consumer Wi-Fi market. However, the lumpy nature of service provider business played a spoilsport. Although the demand for higher-margin SMB products remained quite solid, the segment had limited ability to meet customer demand in a supply-constrained environment with temporary factory closure caused by the Omicron variant. Strong demand for Wi-Fi 6 offerings played a major role. The top line lagged the consensus mark of $259 million.

In 2021, NETGEAR’s revenues totaled $1,168.1 million compared with $1,255.2 million in 2020.

The company shipped nearly 2.7 million units, including 2 million nodes of wireless products, in the fourth quarter. NETGEAR’s recently unveiled Quadband Wi-Fi 6E Orbi system has been applauded by both customers and industry experts. It provides up to 10 gigabit Internet speeds with less interference and lag. NETGEAR is the first company to introduce the quad-band solution to deliver unrivaled Wi-Fi performance to consumers.

Region-wise, net revenues from the Americas were $159.4 million (63.5% of net revenues), down 38.6% year over year. EMEA (Europe, Middle East and Africa) revenues were $50 million (19.9%), down 25.8% while APAC (Asia Pacific Region) revenues grew 4.4% to $41.7 million (16.6%).

The number of registered app users in the reported quarter was 13 million. NETGEAR ended the quarter with 584,000 service subscribers, exceeding its end-of-year projections of 575,000 subscribers for year-over-year growth of 33.6%. The company remains confident of tapping 750,000 paid subscribers by the end of 2022, backed by its higher penetration into the premium segment of the market. This indicates healthy potential for its long-term profitability growth.

Segment Performance

Connected Home, which includes Nighthawk, Orbi, Nighthawk Pro Gaming and Meural brands, generated net revenues of $174.2 million, down 41.2% year over year from $296.1 million owing to soft retail and service provider businesses, with the prior-year period being boosted by elevated consumer demand as a result of the pandemic. However, the segment witnessed strong demand for premium Wi-Fi mesh systems, including tri-band and quad-band Wi-Fi 6 mesh offerings.

The company is making efforts to optimize retail channel partners' inventory levels in the current year period to align them to current demand expectations. NETGEAR holds about 44% share in U.S. retail Wi-Fi market, which includes mesh, routers, gateways and extenders.

Driven by recovering switching business, revenues from SMB rose 8.6% year over year to $77 million. Amid a supply-constrained scenario, the segment showcased strong operational execution on the back of the growing demand for flexible working environments and new business formations. Robust demand for Wi-Fi 6 access points, low port count switches and SMB wireless products coupled with ProAV switching strength drove the momentum. A rise in sophisticated home office settings is expected to augment the SMB unit in the near future. The company holds about 52% share in U.S. retail switch market.

Other Details

Adjusted gross margin decreased to 30% from 30.6% due to lower revenues. Non-GAAP operating margin was 2.7% compared with 11% in the year-ago quarter owing to lower operating income.

Cash Flow & Liquidity

During the fourth quarter, NETGEAR provided $3.9 million of cash from operations. As of Dec 31, 2021, the company had $263.8 million in cash and cash equivalents with $341 million of total current liabilities compared with the respective tallies of $346.5 million and $365.1 million in the year-ago period.

The company repurchased nearly 539,000 shares at an average price of $32.52 per share for $17.5 million during the fourth quarter of 2021. Despite the lingering impact of COVID-19, maintaining robust cash flow and strong liquidity position remain key priorities for NETGEAR in 2022.

Soft Q1 Outlook

For the first quarter of 2022, NETGEAR anticipates net revenues in the range of $225 million to $240 million. The guidance reflects a decline of CHP revenues from the retail channels together with a weak service provider business. SMB unit will also continue to face supply constraints, thereby restricting its ability to achieve full top-line potential.

Owing to the lost leverage from the top line along with increasing freight costs, higher component costs and numerous disruptions on the logistics front, GAAP operating margin is estimated to be in the (1.5)% to (0.5)% range. Non-GAAP operating margin is expected in the range of 1-2%. The company remains optimistic that sea transportation costs will reduce with SMB supply improving in the second half of 2022, thereby creating a favorable environment for top and bottom lines.

Moving Ahead

Given the uncertain macroeconomic conditions stemming from the COVID-19 pandemic, NETGEAR continues to witness supply chain hurdles due to higher freight costs and delivery times, component shortages and productivity woes. However, the San Jose, CA-based company is focused on bolstering its presence in the consumer networking market on the back of higher demand for premium Wi-Fi products in response to the growing hybrid and remote work models and SMB segment strength.

Thanks to its recurring revenue stream, it remains confident of maintaining its leadership in new product introduction based on the Wi-Fi 6 standards. This, in turn, is likely to drive positive cash flow amid a dynamic environment. The company aims to emerge as a pioneer of next-gen networking technologies like Wi-Fi 6 and Pro AV, thereby benefiting from advanced technological innovations. The company intends to capitalize on technology inflections, create new categories, build recurring subscription service revenues, boost its paid subscriber base and optimize channel inventory to propel its momentum.

Zacks Rank & Other Stocks to Consider

NETGEAR currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the industry are Cisco Systems, Inc. CSCO, Extreme Networks, Inc. EXTR and NetScout Systems, Inc. NTCT, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Cisco’s next-year earnings has been revised 0.5% upward over the past 30 days.

Cisco delivered a trailing four-quarter earnings surprise of 1.9%, on average. It has returned 18.8% in the past year. CSCO has a long-term earnings growth expectation of 6.5%.

The Zacks Consensus Estimate for Extreme Networks’ current-year earnings has been revised 8% upward over the past 30 days.

Extreme Networks delivered a trailing four-quarter earnings surprise of 19.1%, on average. EXTR shares have gained 40.4% in the past year.

The Zacks Consensus Estimate for NetScout Systems’ current-year earnings has been revised 0.6% upward over the past 30 days.

NetScout Systems delivered a trailing four-quarter earnings surprise of 21.2%, on average. The stock has gained 3.3% in the past year. NTCT has a long-term earnings growth expectation of 5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

NetScout Systems, Inc. (NTCT) : Free Stock Analysis Report

Extreme Networks, Inc. (EXTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research