November Top Staples Dividend Paying Stocks

Consumer staples demand are considered to be inelastic which means it doesn’t change much over time as consumers treat these products as necessities. Although this sector may not produce spectacular growth, they do provide a strong reliable stream of constant income which is a great diversifier during economic downturns. Below is my list of huge dividend-paying stocks in the consumer staples industry that continues to add value to my portfolio holdings.

Rogers Sugar Inc. (TSX:RSI)

RSI has an appealing dividend yield of 5.88% and is distributing 98.45% of earnings as dividends . While RSI have continued to pay a dividend, there has been no increase in the past 10 years. Analysts are enthusiastic about the company’s future growth, estimating a 30.63% earnings per share increase over the next 12 months.

AGT Food and Ingredients Inc. (TSX:AGT)

AGT has a decent dividend yield of 3.26% and a reasonably sustainable dividend payout ratio , with analysts expecting the payout in three years to be 32.13%. AGT’s dividends have increased in the last 10 years, with DPS increasing from $0.5 to $0.6. They have been consistent too, not missing a payment during this 10 year period. In the last few years, AGT Food and Ingredients has sustained a positive EPS growth. It’s five year average earnings growth is 8.33%.

High Liner Foods Incorporated (TSX:HLF)

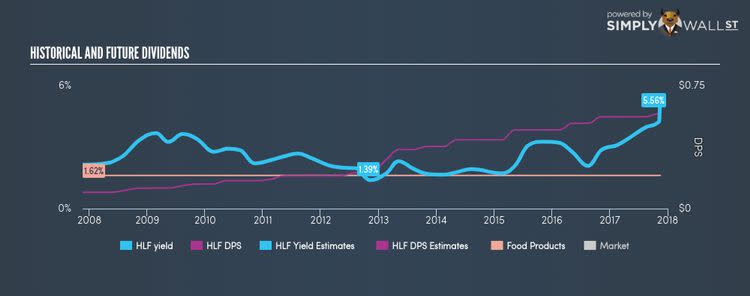

HLF has a great dividend yield of 5.56% and is currently distributing 55.69% of profits to shareholders . The company’s dividends per share have risen from $0.1 to $0.58 over the last 10 years. The company has been a dependable payer too, not missing a payment in this 10 year period. High Liner Foods also looks promising for it’s growth over the next year, with analysts expecting a double digit earnings per share increase of 33.48%.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.