Is Now The Time To Put American Vanguard (NYSE:AVD) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like American Vanguard (NYSE:AVD), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for American Vanguard

How Fast Is American Vanguard Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a falcon taking flight, American Vanguard's EPS soared from US$0.60 to US$0.83, over the last year. That's a impressive gain of 37%.

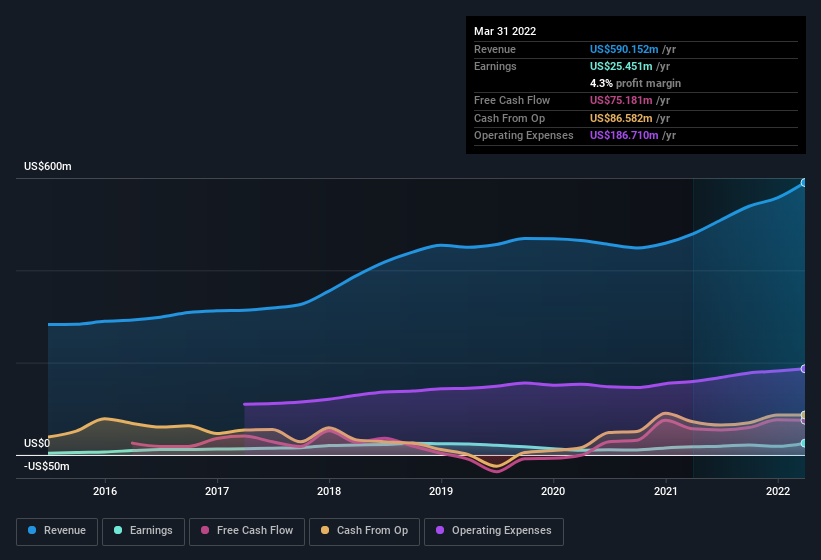

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that American Vanguard is growing revenues, and EBIT margins improved by 3.0 percentage points to 7.2%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for American Vanguard's future profits.

Are American Vanguard Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for American Vanguard shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that COO & Executive VP Ulrich Trogele bought US$44k worth of shares at an average price of around US$14.70.

On top of the insider buying, it's good to see that American Vanguard insiders have a valuable investment in the business. To be specific, they have US$43m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 6.4% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Eric Wintemute is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between US$400m and US$1.6b, like American Vanguard, the median CEO pay is around US$3.9m.

American Vanguard offered total compensation worth US$2.5m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add American Vanguard To Your Watchlist?

For growth investors like me, American Vanguard's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. What about risks? Every company has them, and we've spotted 1 warning sign for American Vanguard you should know about.

The good news is that American Vanguard is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.