NZD/USD Forex Technical Analysis – Friday’s Late Session Recovery Could Fuel Follow-Through Rally

The New Zealand Dollar fell to its lowest level against the U.S. Dollar since January 18 on Friday after a U.S. government report showed a bigger-than-expected jump in non-farm payrolls. The steep break was a continuation of the selling pressure triggered on Thursday by remarks from Federal Reserve Chair Jerome Powell.

Despite losing ground shortly after the release of the jobs report, the Kiwi finished off its low as a rebound in U.S. equity markets signaled renewed demand for riskier assets. This could lead to a follow-through rally next week as investors begin positioning themselves ahead of the Fed’s March 17 policy announcements.

On Friday, the NZD/USD settled at .7163, down 0.0024 or -0.33%.

Rising Treasury yields continue to exert upward pressure on the U.S. Dollar. However, rates fell sharply throughout the session on Friday, giving the New Zealand Dollar a late session boost. If this move continues on Monday, look for the Kiwi to retrace some of last week’s losses.

Daily Swing Chart Technical Analysis

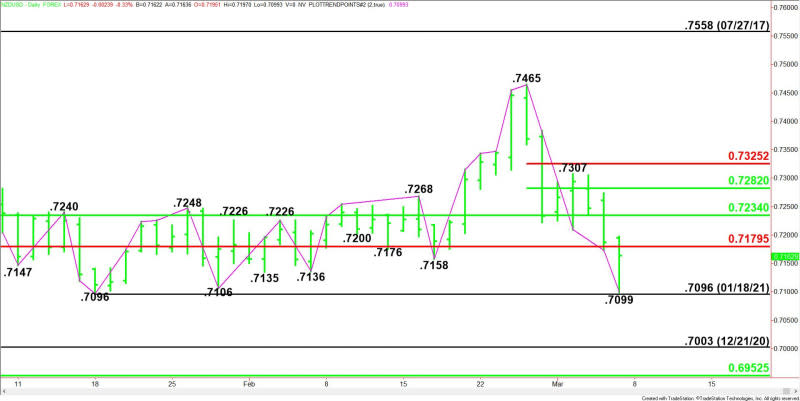

The main trend is down according to the daily swing chart. The trend turned down when sellers took out .7158. It was reaffirmed when the main bottoms at .7136 and .7106 were penetrated. The selling pressure stopped just above the January 18 main bottom at .7096.

The main trend will change to up on a move through .7465. This is highly unlikely, but there is room for a short-term correction or the formation of a closing price reversal bottom.

The minor trend is also down. A trade through .7307 will change the minor trend to up. This will also shift momentum to the upside.

The main range is .7003 to .7465. The NZD/USD is currently trading on the weak side of its retracement zone at .7180 to .7234. This area is now potential resistance.

The minor range is .7465 to .7099. Its retracement zone at .7282 to .7325 is a new potential upside target zone.

Daily Swing Chart Technical Forecast

The early direction of the NZD/USD on Monday is likely to be determined by trader reaction to .7180.

Bearish Scenario

A sustained move under .7179 will indicate the presence of sellers. If this move creates enough downside momentum then look for a potential break into .7099 to .7096.

Bullish Scenario

A sustained move over .7180 will signal the presence of buyers. If this move creates enough upside momentum then look for the rally to possibly extend into .7234. Sellers could come in on the first test of this level. Overtaking it, however, could trigger a further rally into at least .7282.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

More From FXEMPIRE:

The Week Ahead – Economic Data, Monetary Policy, and China in Focus

The Weekly Wrap – Rising Yields and A Dollar Resurgence Was the Story of the Week

U.S Mortgage Rates Break Back Through to 3% as Treasury Yields Climb

NZD/USD Forex Technical Analysis – Friday’s Late Session Recovery Could Fuel Follow-Through Rally

Gold Price Prediction – Prices Rebound Despite a Strong Dollar as Yields Ease