OKEx Execs Talk Expansion, Perpetual Swap, and the Controversial Early Settlement

OKEx is currently the largest exchange by trading volume. It’s also the only exchange to offer derivatives trading as well as spot. This month, they held their NextGen conference in the swanky Ball Room of the Grand Hyatt hotel in Seoul, South Korea. With a smattering of international media and local press as well, CEO Mr. Jay Hao opened up the conference saying:

“We are committed to being the most trustworthy exchange in the industry.”

After the emboldening music and powerful slides in the background with a compelling message, ”it’s OK to be bold,” “it’s OK to make changes,” I couldn’t help but wonder if it was also “OK” to force the early settlement of Bitcoin Cash futures contracts.

OKEx may be gobbling up its fair share of the market but it’s making a few enemies along the way. Innovative? Certainly. Trustworthy? Debatable. The Hong-Kong turned Malta-based exchange probably has some more work to do before it reaches that lofty goal.

Sitting through the presentation about their latest product, however, I wanted to keep an open mind. After all, no one in this largely unregulated space has all the answers and most of us are inherently distrustful.

After a speech from Mr. Junghwan Cho, CEO of OKCoin Korea about the latest developments there, Mr. Lennix Lai, Financial Market Director of OKEx bounded up on stage to announce the launch of ‘Perpetual Swap’, a peer-to-peer virtual derivative with no expiration date.

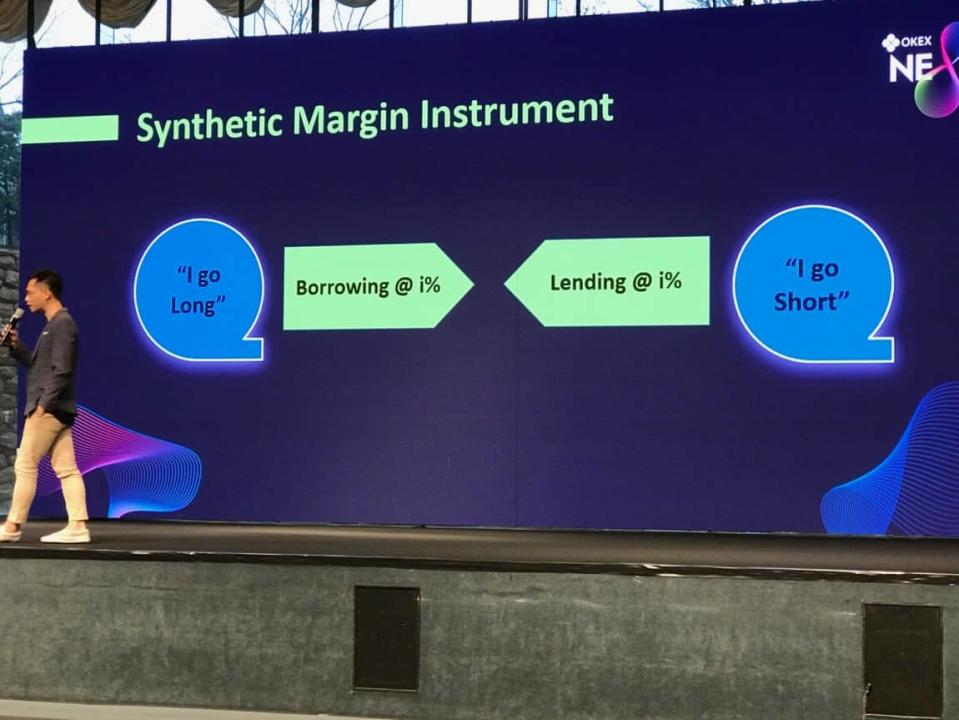

This sophisticated synthetic margin instrument (futures product) is designed for professional traders and launched to compete with BitMEX. And we’ll get into that a little further on.

But if you, like me, want to know more about how the controversial Asian exchange plans to repair its image and beat out Binance on spot and BitMEX on futures, you can hear it straight from the voices at the top.

I caught up with Andy Cheung, Head of Operations at OKEx and Lennix Lui to hear it from them.

The Interview with Andy Cheung

With the endearing (but ever-so-slightly intrusive) tinkling of the grand piano in the lobby bar muffling the recording and not aiding my understanding of a complex crypto financial instrument, I began my interview with Andy starting with the basics.

What exactly is the difference between OKEx and OKCoin? I notice that the two companies’ names are often used interchangeably.

“They are two different companies,” he says. “OKCoin operates in China and has the Korean office, OKEx operates independently and right now the Head Quarters is in Malta…. I joined the company last year… and at the same time, OKCoin was banned in China so that’s when they decided to separate from the company to become OKEx last year with Hong Kong as the operational hub.”

You have an impressive resume coming from Alibaba, Groupon, and a brief stint at APAC. So what convinced you to dive headlong into crypto at a time when it was being banned by some governments?

“Well, we met each other, we discussed things… we actually talked for four months before I decided to jump into this,” he laughs.

Andy was definitely curious but not immediately swayed. Although, from the light in his eyes and the passion in his voice, you can tell he has no regrets. He enthuses:

“I always wish to be in the first bunch of people in a new industry, always working with emerging technologies.”

So, you live in Hong Kong, you’re based in Hong Kong, most of the OKEx team is in Hong Kong–what kind of operations do you have in Malta?

“We just set it up a couple of months ago,” he admits, “so we have a compliance team there, so KYC, we also have a finance team. Pretty much our operations and customer services are still running from Hong Kong but we’re hiring more people there.”

And why did Malta make sense for you as a crypto exchange?

“The government is really friendly about blockchain technology… They are very interested in helping the blockchain industry, support from the government is really important.

We also want to move into the European market, so operating from Malta is a great advantage. So that’s why we set up a team there and also we have a joint venture with the Malta Stock Exchange for the security token exchange. We just signed an MOU so we’re working on the business plan and operations right now.”

You like to be bold and daring at OKEx, but let’s talk a little about recent negative press. Were you expecting there to be such a backlash over the early settlement of Bitcoin Cash futures?

He shuffles slightly for a moment before saying, “We believe that because of the hash war with Bitcoin ABC and SV…” he trails off and then looks at me directly:

“Honestly, we’re actually afraid of people when they do a hash war. It inflates the index price and also the market, so that’s why we decided to settle early and that was the reason behind it. And I would say that after looking at the customer feedback, over 90 percent of customers were thankful to us for doing that because if we didn’t do that the prices went even further down and people would actually have had a much bigger risk than if we hadn’t done it.”

Maybe my face didn’t look entirely convinced, or perhaps he wasn’t satisfied that his answer was complete. He paused then countered before continuing, “Of course there was one company, I don’t want to mention any names…”

Amber AI? I interrupt.

He nods his head.

“Yeah. Well honestly this was the only company complaining from our understanding, that’s why I say that over 90 percent of customers benefited and they were saved from it.”

So you haven’t seen traders leaving?

“No, not at all.”

You don’t expect to?

“No. Not at all. Honestly, there was a little bit of worry at first but after a few days, after we looked at the situation, we didn’t see any impact.”

OK, so moving on. Who are your biggest competitors in this field, who are you trying to beat?

“Binance for sure is our biggest competitor. We’re very strong on the corporate institutional side and also we are the only exchange that operates spot trading and futures.

On the futures side, BitMEX of course. So that’s why we’re launching the perpetual swap to compete with them. I’ll admit that Binance is doing well, they’re doing better than us on the retail side.”

Let’s talk more about the perpetual swap…

“Well, as Lennix explained [during the presentation] it has no expiry date, 100x leverage, but it’s better that you talk to Lennix on the product side.”

On a personal note, Andy grew up in South Africa, a country that he adores and an upbringing that holds very fond memories for him.

“I loved it,” he enthuses, “everything, the weather, the people, we left because of the crime, but when I was a kid in the old days [from his smooth baby face, it’s hard to imagine Andy talking about the “old days” and I have to wonder when that was]. It was a really lovely place, nice beaches, really good weather, reasonable cost of living, everything.”

And does OKEx have a market presence in Africa?

He smiles, “That’s in my mind for 2019… So Europe, the US, we are constantly looking at that and Arica. I think we would look at South Africa first from there and upwards. I’m more familiar with the market, people and connections.”

Going briefly back to Alibaba and Groupon. Can the incumbents work with blockchain tech do you think or they’re going to be replaced by it?

“The reason why Tencent and Alibaba are not really fans of blockchain technology is that they worry that blockchain will replace the internet, e-commerce and all payment rails, so they’re actually not publically talking about it but I know they are investing a lot into looking into blockchain technology. But they’re not telling people.

I think there are two issues here, the investor issue, and also they don’t want the current business model to be affected. They have to responsible for investor relations and they worry to tell people they spend so much on blockchain.”

My last question then, from a top exec and industry expert… when is this bear market going to come to an end?

“I personally believe people are pushing it down because we want more traditional and institutional people to enter the market. It was too high, people were like “what the hell?” Right now it’s a very good price, so traditional people can actually come into the crypto space and then we’ll slowly go up. $3,000 is really cheap to buy right now and then I believe it will go up,” he affirms with confidence.

I thank him and we shake hands. Andy excuses himself leaving his drink practically untouched before a few minutes pass and Lennix enters, greeting me with a bow (which throws me off a little). I also bow, although I’m not sure if I’m doing it right or how low I’m supposed to go. He remains polite and smiling as he sits down.

The Interview with Lennix Lai

So, let’s talk more about the perpetual swap. What type of customer is it for?

“I think the type of customers if you compare to other products, perpetual swap is focused on traders who like big exposure, who like to buy and have a big long position or a big short position, compared with futures.

Futures is more like a product that serves risk management purposes and those who like to hedge their risk first, so it’s very similar between perpetual swap and futures, but because perpetual is traded like spot with leverage, it’s more focused on traders who like to take a bigger position and bigger exposure.”

I see. At least, I think I see, although perhaps a little more context. So it’s more for institutional traders?

“Yeah, well, more for professional traders because it’s not very easy to understand all the features of the trading mechanics, so it’s convenient to buy and sell with leverage but I believe that it’s for professional traders who have a deep understanding of risk profiles and have bigger riskier positions.”

100x leverage and big, risky positions sound a little daunting. Is there some barrier to entry for this or can anyone trade using perpetual swap?

“No, you have to answer the question first before you can start. It’s more like an investor questionnaire. You need to make sure that anyone who would like to trade understands all details and trading rules, how we calculate margin. Make sure you have a very deep understanding of this product first, then you can start trading.

But still, because this question is so difficult [he laughs], it might be best for professional traders, professional traders from other markets, that traded in traditional futures before, they understand the operation and so they understand the risk profile when they’re trading a perpetual swap.”

Right, because the 100 percent leverage is very big?

“Yes,” he smiles:

“It’s very big, it’s very scary.”

Will you be able to sustain that?

“I believe it’s perfectly able to sustain that. 100 percent leverage means you can only open very small positions, if you have a very big position you can’t take 100x leverage, this is our philosophy. You can’t take 1,000, 10,000 contracts, you cannot do that. It’s a risk limit that OKEx has to prevent the type of situation where the market… where a trader explodes.”

Right. So, where is it available? To which customers?

“It’s restricted to the countries we can service, right now, so not the US, not Hong Kong, most other countries.”

With no expiry date, does this mean that OKEx as an exchange couldn’t step in and change the conditions?

“It means that the contract lasts almost forever, in futures the expiry means that on one day the futures price will be equal to the spot price, that’s what futures expiry means, but on the perpetual swap, we don’t have this date. So it’s like the futures trade can never trade on par with spot price, so risk can be de-rated but in order to control that we implement a funding mechanism.

If a trader likes to deviate a lot between the spot price and the futures price you have to pay a lot of money so it discourages people to open long positions if the price is already at a premium or vice versa. So it’s more like a market mechanism trying to anchor our market price to the real thing so that’s called no expiry. It’s convenient to traders that don’t like it when the contracts expire.”

So this is for professional traders, but how much do they need to know on the technology side, the interface basis, do they have to be au fait with crypto terminology?

“Well, I think there is some kind of steep learning curve. If they are already professional derivates traders from other markets, the learning curve is not as steep, it’s not that hard if you are trading but if you want to really capture pricing opportunities, it’s going to take some time to learn it because perpetual swap is not a conventional product.

It’s a crypto-only product. It only exists in the crypto industry. It does not exist on CME, NASDAQ, the Hong Kong Stock Exchange or other traditional financial industries. That is innovation and as well, traders need to learn the swap to understand it.”

And so, with BAKKT coming into the market next year going for US institutional traders, do you think that once you are regulated in Malta, you will be able to go after US clients as well?

“Yes we put all our focus on that already and we are right now discussing internal policy, meaning what are your insider trading rules, what are your staff paying rules, what are your risk management procedures in place, what is your business continuity plan in place… So right now we are sharing all our internal procedures to the Maltese government and they are very happy about that.

I think it’s more like institutional regulated players are going to crypto and crypto is going to be regulated. It’s more getting close together, so for exchanges talking with Malta, the requirement is actually similar with operating an exchange very much like a BAKKT or CME, the requirements are similar. We just need to make sure the regulators have some understanding of the very unique crypto side.

So as a crypto exchange operator, although we don’t have any license right now anywhere in the world, we are getting a lot more transparent. We’re getting a lot more self-regulated according to the philosophy of the principle that’s been operating for 100 years in conventional exchanges, so eventually, we will look exactly the same.”

That’s interesting. And what do you think is the single biggest impact blockchain technology will have on society?

“It’s financial inclusion, to bank the unbanked. It’s already happening and we’re already serving customers that don’t have a robust banking network, they just have a mobile phone, they do need to pay their bills with cash, but with crypto, you can build a crypto-based cash that’s stored in the blockchain network without a physical presence of a banking branch or personnel, all you need is a simple mobile phone so financial inclusion is the next big thing.

Traditional finance is not serving unbanked customers or lowly privileged customers. They are more concentrated on high-level customers, so for mass markets, I think crypto does bring down the cost of operating a financial institution, so we can bring back finance to how it was intended to be. That’s why I changed my career from finance to crypto.”

Coming from a background of traditional finance, what are the biggest challenges that you come up against when you talk about crypto to these traders?

“The main objection is “do you have an insurance? Are my assets insured by some insurance company?” Right now we need time for insurance players to understand the risk, right now crypto insurance is a big topic that’s being discussed, because it is required by many institutions, and custodians, and how we can price and underwrite the risk for crypto exchanges, that is something we will hear more about in 2019.

Many players are starting to do that and evaluate the custodian risk. It’s going to happen, not just on a regulatory side, but because we also want that, our clients want that, it’s just a matter of time.”

We finish. Lennix smiles, stands, and bows once more. I think I get it right this time and I hope I captured all his words despite Frank Sinatra on the grand piano.

Well, I guess the Bitcoin Cash debacle didn’t really work out well for anyone and maybe OKEx was an easy target amidst an excruciatingly volatile period.

Maybe it is OK to be bold. And maybe it’s OK to force early settlement of futures contracts if you believe it’s in your customers’ interests–for now, at least. But if what both Andy and Lennix say is true, it won’t be too long before cryptocurrency exchanges will have to adhere to the same regulation as traditional ones. Then we’ll see what’s really OK when it comes to traders’ funds.

The post OKEx Execs Talk Expansion, Perpetual Swap, and the Controversial Early Settlement appeared first on CCN.