Orthofix (OFIX) Q4 Earnings Beat Estimates, Gross Margin Dips

Orthofix Medical OFIX delivered fourth-quarter 2022 adjusted earnings per share (EPS) of 19 cents, down 29.6% from the year-ago figure. However, the figure beat the Zacks Consensus Estimate of a loss of 37 cents.

The one-time adjustments include expenses associated with long-term income tax rate adjustment, strategic investments and the amortization of acquired intangibles, and medical device regulation charges, among others.

For the fourth quarter, the GAAP loss per share was 35 cents compared with the loss of $1.65 in the year-ago period.

The full-year adjusted EPS was 30 cents, down 65.1% from the year-ago period.

Total Revenues

Revenues in the fourth quarter totaled $122.2 million, down 2.3% year over year on a reported basis but flat at Constant Exchange Rate (CER). The metric beat the Zacks Consensus Estimate by a marginal 0.3%.

Revenues for the full year totaled $460.7 million, down 0.8% year over year (up 1% at CER).

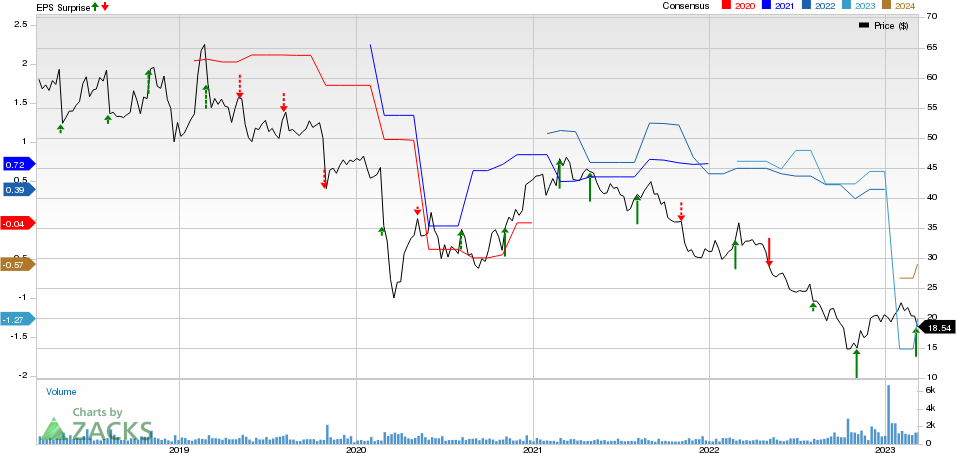

ORTHOFIX MEDICAL INC. Price, Consensus and EPS Surprise

ORTHOFIX MEDICAL INC. price-consensus-eps-surprise-chart | ORTHOFIX MEDICAL INC. Quote

Segmental Details

Across product categories, Bone Growth Therapies’ (“BGT”) revenues totaled $51 million, up 2.8% year over year (up 3% at CER). The rise was driven by revenues from the company’s most recent bone growth therapy solution for fracture care, which grew nearly 50% on a sequential basis.

Revenues from Spinal Implants (comprising of spinal fixation and motion preservation) were $28.8 million, down 7.4% year over year (approximately 7% at CER). The decline is mainly due to the ongoing global competitive headwinds in the motion preservation area and a decline in procedural ASPs in the spine fixation on flat volumes in the United States.

Revenues from the Biologics portfolio grossed $13.7 million, down 9.1% year over year (down 9% at CER). The decline can be attributed to disruptions in the sales channel, partially offset by sales from the company’s new biologic solutions.

In the reported quarter, the Global Spine business's revenues decreased 2.4% year over year to $93.5 million.

The Global Orthopedics business's revenues declined 1.8% year over year (up 6% at CER) to $28.7 million.

Margins

In the reported quarter, gross profit declined 2.8% year over year to $89.2 million. The gross margin contracted 45 basis points to 72.9%.

Sales and marketing expenses increased 3.8% year over year to $59.3 million, whereas general and administrative expenses rose 39.4% year over year to $25 million. However, research and development expenses declined 0.6% year over year to $13.1 million.

The adjusted operating loss for the quarter was $8.7 million against the adjusted operating profit of $3.21 million in the prior-year period.

Operational Update

The company exited 2022 with cash and cash equivalents of $50.7 million compared with $87.8 million at the end of 2021.

Cumulative net cash used in operating activities at the end of 2022 was $11.5 million against the prior-year period’s positive cash flow of $18.5 million.

Cumulative capital expenditure incurred by the company at the end of 2022 were $23.2 million compared with $19.6 million at the end of 2021.

Accordingly, the cumulative free cash flow reported by the company at the end of 2022 was a negative $34.7 million, wider than the free cash outflow of $1.1 million at the prior-year end. The company’s free cash reserves were consumed by strategic investments in inventory, milestone payments related to partnerships, leasehold improvement costs and merger and integration costs, among others.

Merger Details

In January 2023, Orthofix completed its previously announced Merger of Equals with SeaSpine Holdings Corporation. The combined Orthofix-Seaspine looks forward to building a leading global spine and orthopedics company, with highly complementary portfolios of biologics, innovative spinal hardware, bone growth therapies, specialized orthopedic solutions and a leading surgical navigation system.

Under the terms of the merger, a wholly-owned subsidiary of Orthofix will merge with and into SeaSpine. The latter will continue as the surviving company and a wholly-owned subsidiary of Orthofix.

The combined company structure will continue to be known as Orthofix Medical Inc., till it is renamed afterward.

2023 Outlook

Orthofix provided its guidance for 2023 and the first quarter. The guidance assumes the current foreign currency exchange rates to be the same throughout the year.

For 2023, the company expects net sales for the year to be $743-$753 million, suggesting year-over-year growth of 7-9% at CER. This compares favorably with revenues for 2022 of approximately $701 million reported in the Pro forma financials, after taking into account anticipated reclassifications to conform SeaSpine's revenue reporting to that of Orthofix.

The Zacks Consensus Estimate for the same is pegged at $515.6 million.

Net sales for the first quarter of 2023 are expected to be $166-$170 million, suggesting a year-over-year increase of 7-10% at CER. This is in contrast to the combined company revenues of nearly $158 million reported in the Pro forma financial statement for the first quarter of 2022.

The Zacks Consensus Estimate for the same is pegged at $112.4 million.

Investors should note that any sales generated by SeaSpine during the pre-merger period of Jan 01-04, 2023, will not be included in the combined company's first-quarter or 2023 revenue results.

Our Take

Orthofix exited the fourth quarter of 2022 with better-than-expected earnings, while revenues exceeded by a close margin. Several additions within the products category during the year, such as AccelStim bone healing therapy, TrueLok EVO, and Galaxy Gemini, were well-received in the market.

Post-merger, Orthofix remains committed to developing creative, quality-driven procedural solutions through expanded commercial access and making meaningful investments in organic and inorganic innovation. The comprehensive product offerings will potentially address the unmet clinical needs in the musculoskeletal space, thus serving patients worldwide.

However, barring BGT, the year-over-year decline in segmental revenues is discouraging. Contraction in both margins also does not bode well. The adjusted operating loss in the reported quarter is attributed to higher spending on legal and professional fees related to the recent merger, and an increase in marketing and sales training expenses.

Zacks Rank and Stocks to Consider

Orthofix currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Avanos Medical AVNS, ConforMIS CFMS and LivaNova LIVN.

Avanos Medical, currently carrying a Zacks Rank #2 (Buy), reported its fourth-quarter 2022 adjusted EPS of 60 cents, which beat the Zacks Consensus Estimate by 25%. Revenues of $218 million outpaced the consensus mark by 1.11%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Avanos Medical has an estimated earnings growth rate of 19.05% for one year. AVNS’ earnings surpassed estimates in all the trailing four quarters, the average being 11.01%.

ConforMIS, with a Zacks Rank #2, reported a fourth-quarter 2022 loss of 51 cents per share, which beat the Zacks Consensus Estimate by 72.28%. Revenues of $17 million outpaced the consensus mark by 25.87%.

ConforMIS has an estimated earnings growth rate of 17.41% for a year. CFMS’ earnings surpassed estimates in one of the trailing four quarters and missed the same in the other three, the average being 4.23%.

LivaNova reported fourth-quarter 2022 adjusted earnings of 81 cents per share, beating the Zacks Consensus Estimate by 12.5%. Revenues of $275 million surpassed the Zacks Consensus Estimate by 4.12%. The company currently carries a Zacks Rank #2.

LivaNova has an estimated earnings growth rate of 17.83% for a year. LIVN’s earnings surpassed estimates in three of the trailing four quarters, and missed the same in one, the average surprise being 2.62%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ORTHOFIX MEDICAL INC. (OFIX) : Free Stock Analysis Report

ConforMIS, Inc. (CFMS) : Free Stock Analysis Report

LivaNova PLC (LIVN) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report