OTIS' Product Innovation & Services Business to Drive Growth

Otis Worldwide Corporation OTIS has been delivering strong results over the past few quarters despite currency woes and extensive technology expenses. This uptrend is mainly driven by the company’s innovation strategy, investments in research and development ("R&D") and strong performance in the Services unit.

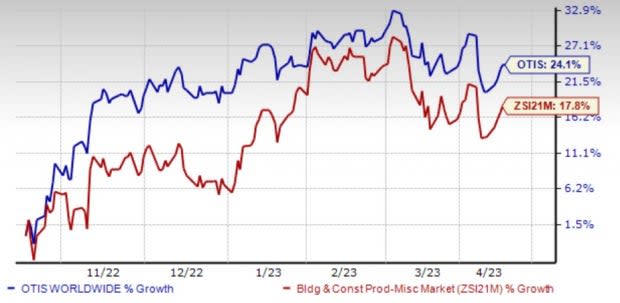

In the past six months, this leading elevator and escalator manufacturing company gained 24.1%, outperforming the Zacks Building Products - Miscellaneous industry’s 17.8% growth. In the same period, the Zacks Construction sector and S&P 500 Index grew 21.7% and 12.4%, respectively. The solid move is mainly backed by strong earnings surprise history and positive analysts’ expectations.

The company has surpassed the Zacks Consensus Estimates in the trailing 12 quarters. For 2023, the earnings estimate is currently pegged at $3.43 per share, up 8.2% from 2022 level on 1.9% higher revenues.

Image Source: Zacks Investment Research

Let’s delve deeper into the factors boosting this leading elevator and escalator manufacturer’s growth trajectory.

Strong New Equipment & Services Business: Otis has been banking on strong orders in the New Equipment unit. Orders were up 7% in 2022 and backlog increased 3% at 2022-end and adjusted backlog increased 11% at constant currency.

In 2022, the Service unit’s net sales and adjusted net sales rose 6.1% and 6.3%, respectively, year over year, excluding foreign exchange headwinds. Adjusted operating and profit margins both expanded by 50 bps.

Solid 2023 Guidance: For 2023, the company expects net sales to be within $13.8-$14.1 billion. The new projection indicates 1.5-4% year-over-year growth. Organic sales growth is projected to be 4-6% (up 3-5% for New Equipment and up 5-7% for Service). Adjusted operating profit is projected to be $2.2-$2.25 billion, up $130-$175 million at constant currency and up $70-$130 million at actual currency.

Adjusted earnings per share are anticipated to be $3.35-$3.50, suggesting 6-10% year-over-year growth. The adjusted effective tax rate is likely to be 26-26.5%. Free cash flow is expected to be $1.5-$1.55 billion.

Product Innovation Drive Bode Well: OTIS’ emphasis on innovation is core to its strategy. Last year, it invested $150 million or 1.1% of net sales, in R&D after investing $159 million in 2021. The company maintained its R&D investment, particularly in product innovation with its Gen3 offering.

Otis connects global R&D efforts through an operating model that sets global and local priorities based on customer and segment needs. In 2021, it launched the successors to the Gen2 family of elevators: the Gen3 and Gen360 digital elevator platforms. These platforms enhance the space-saving, energy-efficient design of the Gen2 elevator with the connectivity of the Otis ONE IoT (Internet of Things) digital service platform. At the end of 2022, it had 11 R&D centers and 17 factories across the world, primarily in China, India, France, Spain and the United States.

As of Dec 31, 2022, the company owned approximately 4,200 globally issued patents and nearly 2,300 patent applications were pending globally, of which 1,300 applications were filed in the last three years. It expects to continue innovating and expanding the digital ecosystem and suite of digital solutions for both the existing service portfolio customers and new equipment shipments from factories.

Strong Liquidity: OTIS ended 2022 with $1.19 billion in cash and cash equivalents along with a $1.5-billion unsecured, unsubordinated five-year revolving credit facility. At the end of December 2022, its long-term debt totaled $6.098 billion, down from $7.25 billion at 2021-end.

It also focuses on enhancing shareholders’ value via regular dividends and repurchases. It generated $1.44 billion in free cash flow while continuing to return cash to shareholders in 2022. The company has increased its dividend by 45% since it became a public company. Also, it repurchased an $850-million share of its common stock, at the end of 2022.

Zacks Rank & Key Picks

Currently, Otis carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the same space are:

Installed Building Products, Inc. IBP, sporting a Zacks Rank #1, is a leading installer of insulation and complementary building products. It primarily banks on a robust pipeline of acquisition opportunities across multiple geographies, products and end markets.

Installed Building’s earnings for 2023 are expected to decline 5.7%. Nonetheless, the same has moved north to $8.44 per share from $7.45 per share over the past 60 days, reflecting analysts’ optimism for its growth potential.

CRH plc CRH currently carries a Zacks Rank #2. The long-term earnings growth rate is anticipated to be 10.2%.

The Zacks Consensus Estimate for CRH’s 2023 sales and EPS indicates growth of 6% and 9.2%, respectively, from the previous year’s reported levels.

Masco Corporation MAS, carrying a Zacks Rank #2, manufactures, sells and installs home improvement and building products. MAS benefits from its market-leading brands, acquisition synergies and cost-saving moves. Notably, its solid long-term growth prospect amid slow housing demand is commendable.

Masco’s earnings for 2023 are expected to decline 13%, but the same is also expected to grow 4.9% in the long run.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

CRH PLC (CRH) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report