What You Need To Own In Your Portfolio

Some investors like great businesses with a cheap price tag, which will allow them to reap capital gains as the price moves towards the true value of the company. Other investors like to bet on high-growth companies and their potential to grow further. I’ve composed a list of companies that delivered strong outcome for two or more fundamental aspects, making them sought-after investments for any portfolio.

Economic Investment Trust Limited (TSX:EVT)

Economic Investment Trust Limited is a closed-ended equity mutual fund launched and managed by Burgundy Asset Management Ltd. Economic Investment Trust was formed in 1927 and with the stock’s market cap sitting at CAD CA$651.96M, it comes under the small-cap category.

EVT’s earnings growth in the past year of 87.18%, exceeding its industry expansion of -7.56%, is an impressive feat for the company. EVT’s upcoming commitments are met by its short-term assets, and the business has no debt on its books, portraying its strong financial capacity. Likewise, EVT’s shares are now trading at a price below its true value based on its discounted cash flows, and its relative PE ratio compared to its industry, so potential investors can purchase the stock below its value. Continue research on Economic Investment Trust here.

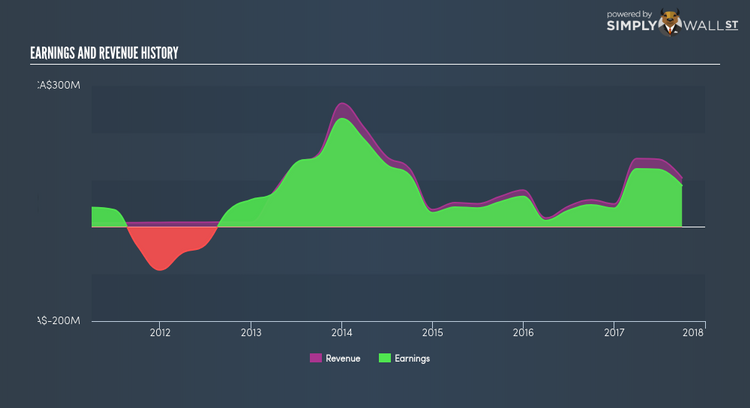

Badger Daylighting Ltd. (TSX:BAD)

Badger Daylighting Ltd. provides non-destructive excavating and related services in Canada and the United States. Started in 1992, and currently headed by CEO Paul Vanderberg, the company now has 1,605 employees and with the market cap of CAD CA$931.60M, it falls under the small-cap stocks category.

One reason why investors are attracted to BAD is its earnings growth potential in the near future of 27.33% beating the market average earnings growth rate of 3.53%. In addition to this, BAD has sufficient cash and investments to meet its upcoming liabilities, and its debt is adequately covered by its operating cash, demonstrating financial stability and good capital management. Interested in Badger Daylighting? Find out more here.

FirstService Corporation (TSX:FSV)

FirstService Corporation provides property services to residential and commercial customers in the United States and Canada. Established in 1988, and headed by CEO D. Patterson, the company employs 18,000 people and with the company’s market cap sitting at CAD CA$3.13B, it falls under the mid-cap category.

FSV’s ability to grow its earnings in the past at 57.98%, leading to an equally impressive triple-digit return on equity, is a rewarding treat for company shareholders. Last but not least, FSV’s upcoming commitments are met by its short-term assets, and its total debt is well-covered by its cash flows, which indicates its strong financial position. Interested in FirstService? Find out more here.

For more fundamentally-robust companies with industry-beating characteristics to enhance your portfolio, use our free platform to explore our interactive list of big green snowflake stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.