S&P 500 Likely to Trade Rangebound in September: 5 Picks

Wall Street started September with severe volatility after a disappointing August. The two-month long summer rally from mid-June to mid-August has evaporated as investors become highly concerned about a recession in the near future.

U.S. stock markets ended in green in just two months, March and July, out of the first eight months of 2022. September is historically known as the worst performing month on Wall Street. This year, the situation is more complicated as the Fed has to do a balancing act between combating inflation and maintaining the economy’s stability.

Consequently, we believe the market’s benchmark – the S&P 500 Index – may remains rangebound in September. In order to make a profit in the mid-to-long term, it will be prudent to invest in S&P 500 stocks that have popped up in 2022. Investors should buy or add more of these stocks to their portfolio on every dip.

Five such S&P 500 stocks are — Archer-Daniels-Midland Co. ADM, Corteva Inc. CTVA, McKesson Corp. MCK, Marathon Petroleum Corp. MPC and Exxon Mobil Corp. XOM.

Markets May Trade Sidewise

Wall Street’s summer rally faded following Fed Chairman Jerome Powell’s annual Jackson Hole Symposium lecture in which he reiterated the central bank’s decision to maintain rigorous interest rate hikes and tighter monetary policies until inflation cools down to the Fed’s target rate of 2%. Currently, the inflation rate is at a 40-year high.

A large section of market participants was hoping for a rate cut in 2023, which at present, looks like a remote possibility. As a result, investors are highly concerned about a recession in the U.S. economy in the near future. Fed Chairman has also warned of toughness going forward.

Per CME FedWatch, at present, 64% of the market respondents are expecting a 75 basis-point rate hike in the September FOMC. Thereafter, there is a 53.2% probability of a rate hike of 50 basis points in the November FOMC and a 52.6% probability of another 25 basis-point rise in the December FOMC.

The second-quarter 2022 earnings results were better than expected despite the margin squeeze. However, we are seeing a significant drop in earnings projection for the third quarter. As of Sep 2, our estimate projected 1.4% growth in earnings per share, well below the 7.6% projected on Jun 1.

The U.S. GDP growth rate contracted in the first two quarters of this year. Recently released several economic data have shown softening in both consumer and business spending. The global supply-chain system is yet to recover from the pandemic-led devastation primarily due to lingering economic hardness in China.

Therefore, the S&P 500 is likely to stay rangebound in 2022. Year to date, the broad-market index is down 17.7%. Last week, the index along with the Dow 30 posted losses for four successive weeks.

Our Top Picks

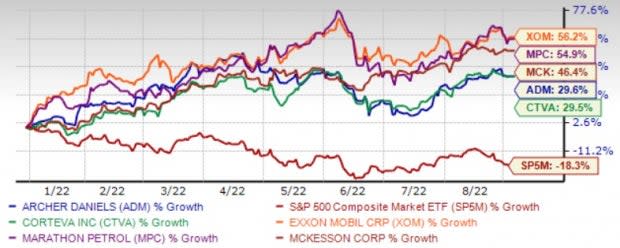

We have narrowed our search to five S&P 500 stocks that have popped year to date despite the index’s bloodbath. These stocks have more upside left for the rest of 2022 and have seen positive earnings estimate revisions in the past 60 days.

These companies are regular dividend payers, which will act as income stream during the market’s downtrend. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Archer-Daniels-Midland has been gaining from solid demand, improved productivity and product innovations. Persistent growth in the Nutrition segment of ADM, aided by significant gains in the Human and Animal Nutrition units, remained the key growth driver.

Archer-Daniels-Midland expects the nutrition segment to record operating profit growth of 20% in 2022. The company has been significantly progressing on its three strategic pillars — optimize, drive and growth.

Archer-Daniels-Midland has an expected earnings growth rate of 31.6% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.2% over the past 60 days. The stock price of ADM has appreciated 29.6% year to date. It has a current dividend yield of 1.83%.

Corteva operates in the agriculture business. CTVA operates through two segments, Seed and Crop Protection. Corteva develops and supplies germplasm and traits in corn, soybean and sunflower seed markets. CTVA also supplies products to the agricultural input industry that protects against weeds, insects and other pests, and diseases as well as enhances crop health.

Corteva has an expected earnings growth rate of 20% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.2% over the past 30 days. The stock price of CTVA has advanced 29.5% year to date. It has a current dividend yield of 1%.

Exxon Mobil’s bellwether status and an optimal integrated capital structure, which have historically led to industry-leading returns, make it a relatively lower-risk energy sector play. The integrated oil giant expects to reduce greenhouse gas emissions by 30% in its upstream business.

By then, XOM expects to reduce flaring and methane emissions by 40%. With the reopening of the global economy, crude oil prices are likely to remain high despite near-term growth concerns.

Exxon Mobil has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the past seven days. The stock price of XOM has jumped 56.2% year to date. It has a current dividend yield of 3.68%.

Marathon Petroleum is poised for further price gains based on a slew of positives. MPC’s $21 billion sales of its Speedway retail business provided it with a much-needed cash infusion. The deal also comes with a 15-year fuel supply agreement under which Marathon Petroleum will supply 7.7 billion gallons of gasoline per year to 7-Eleven, thus ensuring a steady revenue stream.

MPC’s exposure to more stable cash flows from the logistics segment diversifies the earnings stream and offers a buffer against the volatile refining business. Consequently, Marathon Petroleum is primed for significant capital appreciation and is viewed as a preferred downstream operator to own now.

Marathon Petroleum has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the past seven days. The stock price of MPC has climbed 54.9% year to date. It has a current dividend yield of 2.34%.

McKesson provides pharmaceuticals and medical supplies in the United States and internationally. Strong fiscal first-quarter show by three of the four segments of MCK is encouraging. A strong earnings outlook for fiscal 2023 instill optimism.

Strong adjusted operating profit growth across key segments of MCK is encouraging. A strong position in the Distribution market continues to favor the stock. McKesson played a crucial role in the COVID-19 response efforts in the United States and abroad via the distribution of COVID-19 vaccines, ancillary supply kits, and COVID-19 tests.

McKesson has an expected earnings growth rate of 2.3% for the current year (ending March 2023). The Zacks Consensus Estimate for current-year earnings has improved 2.9% over the past 30 days. The stock price of MCK has surged 46.4% year to date. It has a current dividend yield of 0.60%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Corteva, Inc. (CTVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research