Paramount Global (PARA) Q2 Earnings Beat, Revenues Rise Y/Y

Paramount Global PARA delivered adjusted earnings of 64 cents per share in second-quarter 2022, which beat the Zacks Consensus Estimate by 3.23% but declined 34% year over year.

Revenues of $7.78 billion surpassed the Zacks Consensus Estimate by 2.47% and improved 19% year over year, owing to an increase in Filmed Entertainment and Direct-to-Consumer revenues.

Adjusted OIBDA declined 22% from the year-ago quarter’s level to $963 million.

Selling, general and administrative expenses increased 17.2% year over year to $1.71 billion.

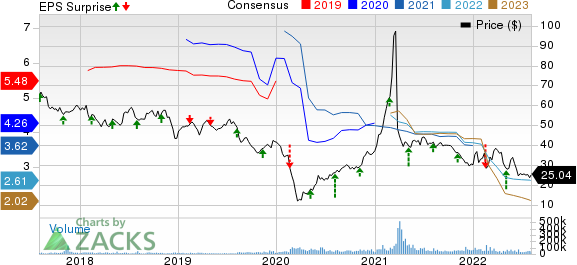

Paramount Global Price, Consensus and EPS Surprise

Paramount Global price-consensus-eps-surprise-chart | Paramount Global Quote

Revenues by Type

Advertising revenues of $2.54 billion decreased 2.1% year over year. Affiliate revenues of $2.89 billion increased 11.6% year over year, reflecting expanded distribution and higher reverse compensation.

Theatrical revenues totaled $764 million in the reported quarter compared with the year-ago quarter’s $134 million. Content-licensing revenues of $1.58 billion surged 27.3% year over year.

Segment Details

Paramount’ Direct-To-Consumer revenues increased 56% year over year to $1.19 billion. Direct-To-Consumer subscription revenues soared 74% year over year to $830 million, reflecting paid subscriber growth on Paramount+.

Global streaming subscribers rose to nearly 64 million, which included the addition of 5.2 million new subscribers and the removal of 3.9 million Russian subscribers in the quarter. Subscriber additions were driven by Paramount+, which added 4.9 million subscribers in the second quarter, taking Paramount+ total subscribers to almost 43 million.

Domestically, Paramount+ saw strong engagement and consumption due to a variety of content, including Halo, 1883, The Lost City, Sonic the Hedgehog 2, Jackass Forever, Star Trek: Strange New Worlds, andtheUEFA Champions League.

Pluto TV’s global monthly active users (MAUs) increased to nearly 70 million. Pluto TV expanded its international presence by launching in the Nordics in partnership with Viaplay Group and announced a collaboration with Corus in Canada.

Direct-To-Consumer advertising revenues increased 25% year over year to $363 million, reflecting growth from Pluto TV and Paramount+, driven by increased pricing and impressions on both services.

TV Media revenues increased 1% year over year to $5.26 billion, which reflected growth in content licensing revenues. However, the growth slowed down due to lower advertising and affiliate revenues.

Paramount’s cable portfolio had the #1 share of viewing in almost every key demo. Nickelodeon was the #1 network, and its portfolio delivered its highest year-over-year share growth since second-quarter 2017.

TV Media’s adjusted OIBDA declined 8% from the year-ago quarter’s figure to $1.38 billion due to lower advertising and affiliate revenues.

Filmed Entertainment revenues increased 126% year over year to $1.36 billion, owing to staggering growth in Theatrical revenues. Theatrical revenues of $764 million increased by $294 million year over year and included revenues from the second-quarter releases of Top Gun: Maverick and Sonic the Hedgehog 2. Licensing revenues were $587 million, up 27% year over year.

Balance Sheet

As of Jun 30, 2022, Paramount had cash and cash equivalents of $4.03 billion compared with $5.3 billion as of Mar 31, 2022.

Paramount Global’s committed $3.5 billion revolving credit facility remains undrawn.

Total debt as of Jun 30, 2022, was $15.8 billion, down from a total debt of $16.8 billion as of Mar 31, 2022.

Zacks Rank & Stocks to Consider

Paramount currently carries a Zacks Rank #3 (Hold).

The company’s shares have declined 16.6% in the year-to-date period compared with the Zacks Consumer Discretionary sector’s decline of 29.6%.

Here are some better-ranked stocks worth considering in the broader sector.

DraftKings DKNG carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DKNG’s shares have decreased 41.4% in the year-to-date period compared with the Zacks Gaming industry’s decline of 31.9%. DKNG is scheduled to report second-quarter 2022 results on Aug 5.

Enthusiast Gaming EGLX carries a Zacks Rank #2.

EGLX’s shares have fallen 35.4% in the year-to-date period in the Zacks Gaming industry. EGLX is scheduled to report second-quarter 2022 results on Aug 15.

Century Casinos CNTY carries a Zacks Rank #2.

CNTY’s shares have slumped 28.2% in the year-to-date period compared with the Zacks Gaming industry. CNTY is scheduled to report second-quarter 2022 results on Aug 5.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Century Casinos, Inc. (CNTY) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report

Enthusiast Gaming Holdings Inc. (EGLX) : Free Stock Analysis Report

Paramount Global (PARA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research