Some Pasinex Resources (FRA:PNX) Shareholders Have Copped A Big 65% Share Price Drop

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held Pasinex Resources Limited (FRA:PNX) over the last year knows what a loser feels like. The share price is down a hefty 65% in that time. On the other hand, the stock is actually up 4.9% over three years. Unfortunately the share price momentum is still quite negative, with prices down 8.5% in thirty days.

Check out our latest analysis for Pasinex Resources

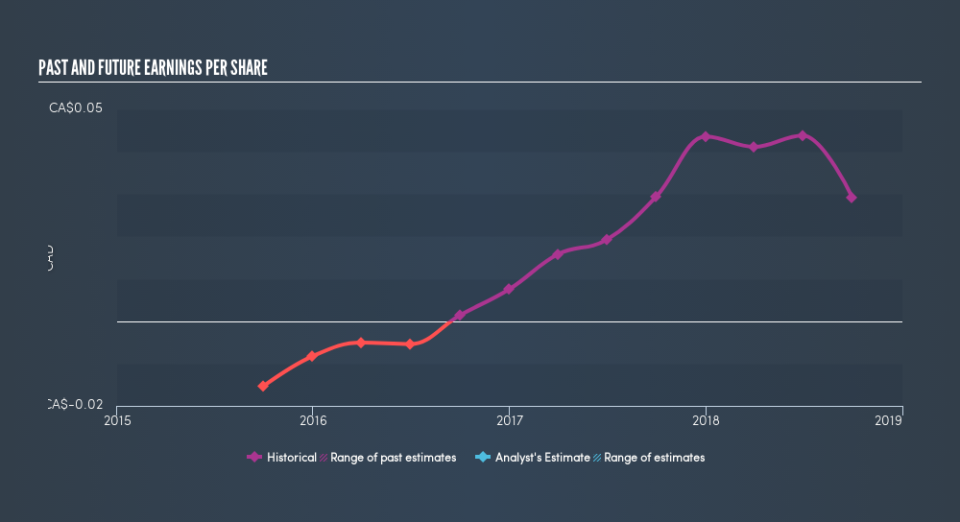

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Pasinex Resources had to report a 0.7% decline in EPS over the last year. The share price decline of 65% is actually more than the EPS drop. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock. The P/E ratio of 2.22 also points to the negative market sentiment.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Pasinex Resources's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 4.8% in the twelve months, Pasinex Resources shareholders did even worse, losing 65%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Pasinex Resources's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Pasinex Resources may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.