PerkinElmer Completes Transformation to Become Revvity

On Tuesday, May 16, the name PerkinElmer and its PKI symbol disappeared from the stock market. In its place is a piece of the old company, branded as Revvity Inc. (NYSE:RVTY).

PerkinElmer was formed by Richard Perkin and Charles Elmer in 1937 as a precision optics company. In the years since, the company has transformed itself several times by acquiring and divesting businesses.

The most recent and transformational change began when PerkinElmer announced on Aug. 1, 2022 that it would sell its Applied, Food and Enterprise Services business to New Mountain Capital.

At the time of the announcement, the deal was worth $2.45 billion and included the PerkinElmer name. That left the life sciences and diagnostics businessesand the need for a new name.

That new name, Revvity, is the combination of two words: revolutionize (rev) and vitae (vit), the Latin word for life. Management describes the new company as a science-based solutions company that leverages innovation across life sciences and diagnostics to help improve lives everywhere.

Also, according to its May 9 news release, Revvity provides reagents, consumables, assays, instruments and software to customers in markets ranging from pharma and biotech, diagnostic labs, academia and government agencies.

As I wrote in August, PerkinElmer was in the process of ending its days as a conglomerate and becoming a pure play. It is one of many corporations that have followed the same track in recent years.

All of them want to become more attractive to existing and potential shareholders by focusing more on their most promising divisions and selling or spinning off the rest.

The original news release on the Applied, Food and Enterprise Services divestiture listed two anticipated benefits. First, the company will become a high-growth, high-margin, less cyclical business with significant recurring revenues and scale.

Second, it will have more financial flexibility, allowing it to invest more in internal innovation and expand into the most attractive end markets.

In announcing the divestiture, PerkinElmer expected to see its gross margin expand from 50% (in 2019) to 60% in coming years. It also expects the proportion of recurring revenue to jump from about 65% to about 80%.

And perhaps most importantly, adjusted earnings per share growth is anticipated to grow from around 10% per year to 13% to 15% per year.

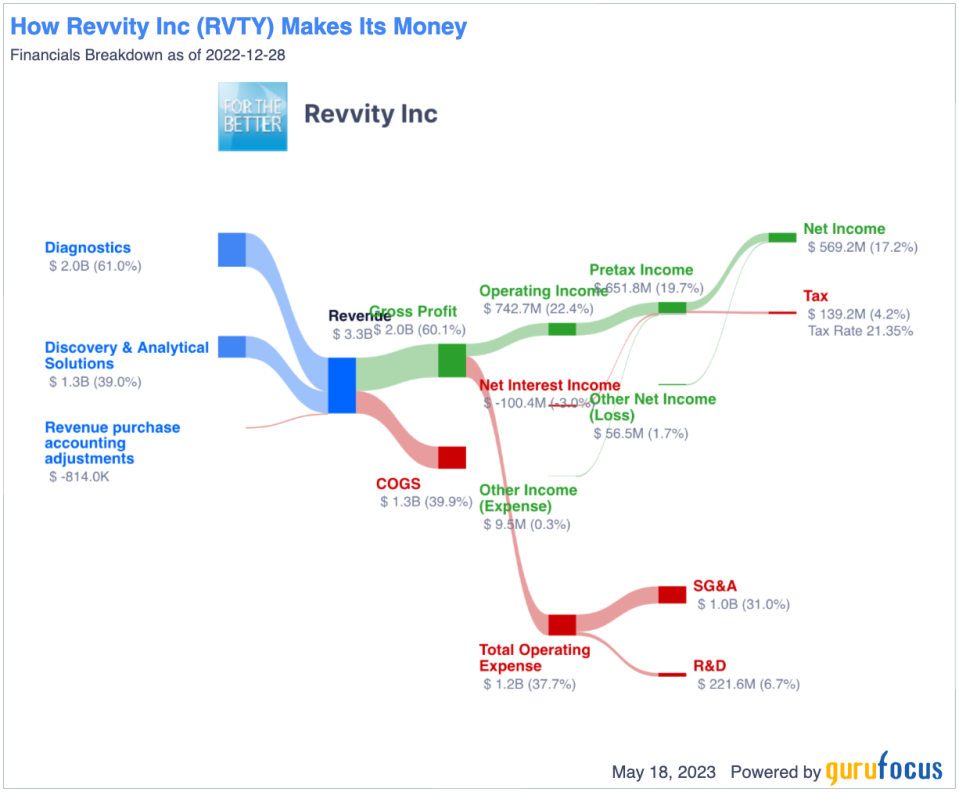

The divestiture was completed on March 13. Revvitys financial data has been restated to include just the two remaining divisions, diagnostics and discovery and analytical solutions:

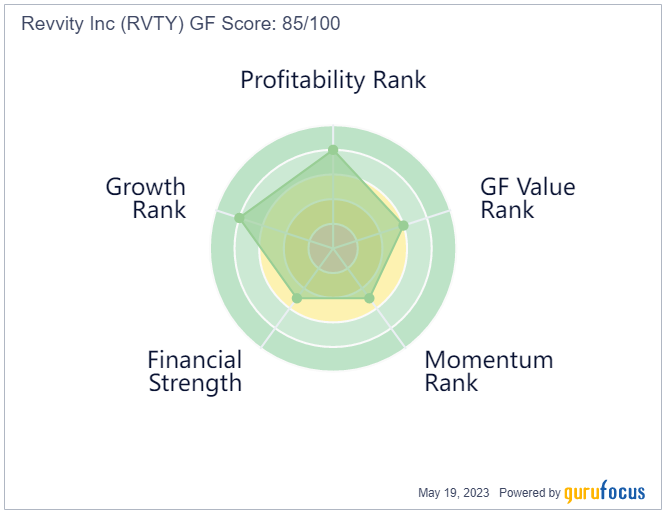

For an overview of its fundamentals, we can use the GF Score. At 85 out of 100, we should expect it to be doing reasonably well.

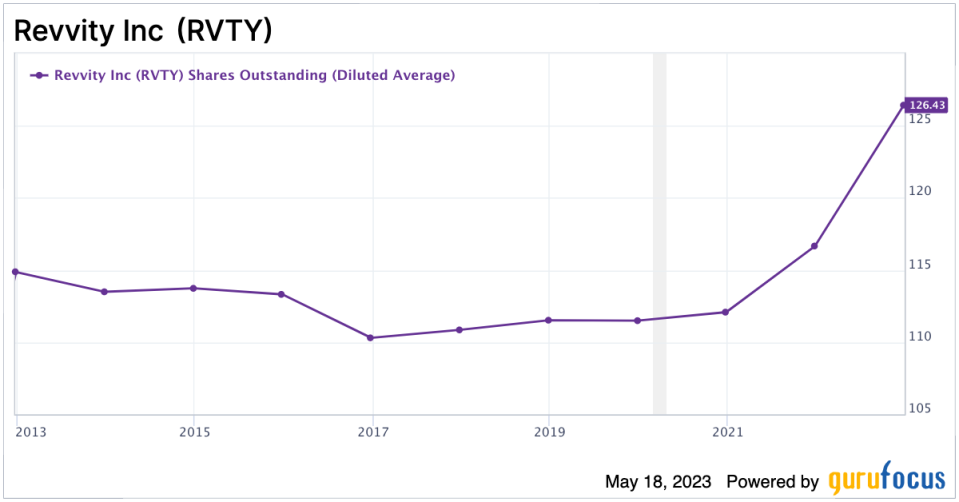

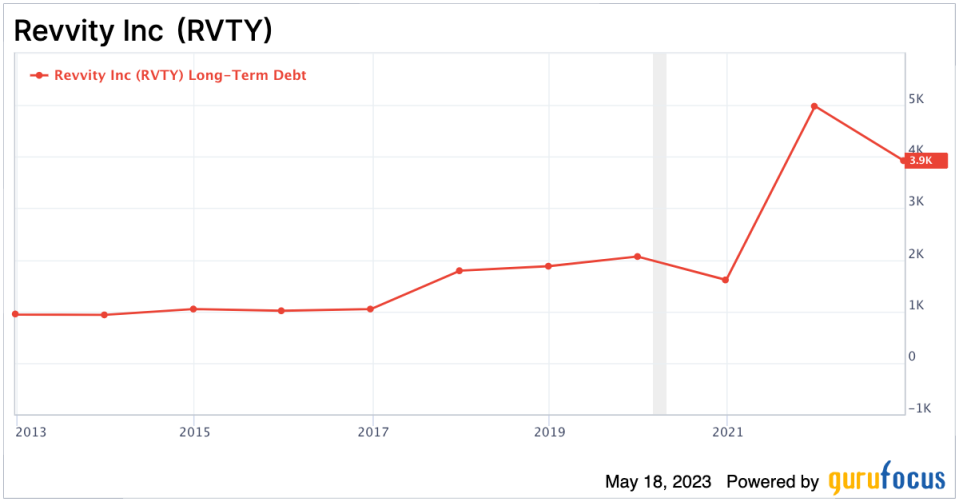

However, its financial strength is impaired by the boatload of debt it has incurred. It also diluted the value of existing shareholder holdings by issuing a significant number of new shares in the past two years.

This chart shows how long-term debt shot up in 2021, and then was pared back somewhat in 2022.

Data on profitability is more encouraging, with a net margin of 28.64% and a return on equity of 13.05%.

It is much the same story regarding growth. While the three-year average revenue growth rate has been 0.40% per year, Ebitda has averaged 26.50% and earnings per share without non-recurring items has averaged 25.80%.

A Morningstar analyst expects earnings per share without NRI growth of more than 10% per year over the next three years: $5.11 for 2023, $5.82 for 2024 and $6.67 for 2025.

For the 14 analysts following Revvity and watched by Nasdaq.com, the consensus is a buy rating.

For the company to keep growing, it needs solid free cash flow growth, and is getting it. Free cash flow has averaged 22.90% per year over the past three years.

Some of that will be needed to pay dividends, which yield 0.24% on the May 18 share price of $116.84. For 2022, free cash flow totaled $594 million, while cash for dividends was $35 million. Since the company was issuing rather than repurchasing shares last year, that left $559 million for growth initiatives.

The share price is either fairly valued or undervalued, depending on the metrics. Looking at a three-year price chart, we can see the share price is down from its previous highs. In part, that is because of the 2022 bear market (marked with a vertical line) and in response to the restructuring announced last August (the second vertical line).

The GF Value Line estimated Revvitys intrinsic value at $120.48, only a few dollars higher than the May 18 closing price of $116.84.

Its price-earnings multiple is 15.21, which is better than the medical diagnostics and research industry median of 21.96. The PEG ratio is 1.45, which is in the middle of the fair value range.

Further, the gurus have been buying more often than they have been selling in three of the past four quarters.

Nine gurus held shares of Revvity at the end of the first quarter. Nearly three quarters of the shares, 73.73%, have been purchased by institutional investors.

Insiders hold 1.97%. Among them, the biggest stake is that of Dr. Prahlad Singh, the president and CEO. He held 83,016 shares as of Feb. 16.

In conclusion, PerkinElmer has now completed a transformation project that has been several years in the making. Now trading under that name Revvity, the fundamentals indicate the company is off to a good start. Shares are selling at fair price, so now we must wait to find out if this new strategy will deliver on those anticipated benefits.

This article first appeared on GuruFocus.