Pioneer Investments Cuts Linde, McDonald's

Pioneer Investment Management sold shares of the following stocks during the fourth quarter of 2019.

Linde

The guru trimmed the Linde PLC (LIN) position by 24.61%. The portfolio was impacted by -0.53%.

The gas supplier has a market cap of $113.80 billion and an enterprise value of $127.5 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 4.55% and return on assets of 2.58% is underperforming 62% of companies in the chemicals services industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.19 is below the industry median of 0.61.

Pioneer Investments (Trades, Portfolio) is the largest guru shareholder with 1.02% of outstanding shares, followed by Sarah Ketterer (Trades, Portfolio)'s Causeway Capital Management with 0.86% and Dodge & Cox with 0.80%.

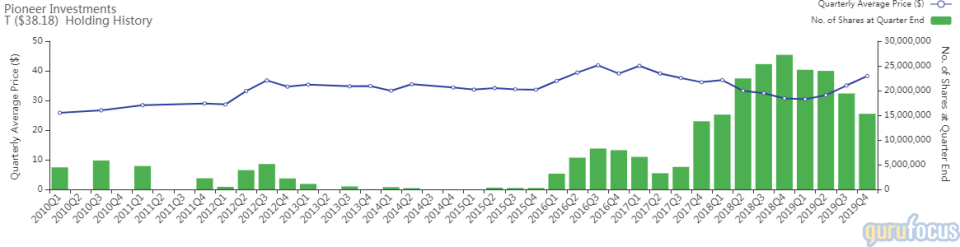

AT&T

The investor curbed his AT&T Inc. (T) position by 21.19%. The portfolio was impacted by -0.23%.

The wireless carrier has a market cap of $272 billion and an enterprise value of $463 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 7.55% and return on assets of 2.55% are outperforming 53% of companies in the telecommunication services industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.07 is below the industry median of 0.27.

Pioneer Investments (Trades, Portfolio) is the largest guru shareholder with 0.21% of outstanding shares, followed by Paul Singer (Trades, Portfolio) with 0.07% and Barrow, Hanley, Mewhinney & Strauss with 0.06%.

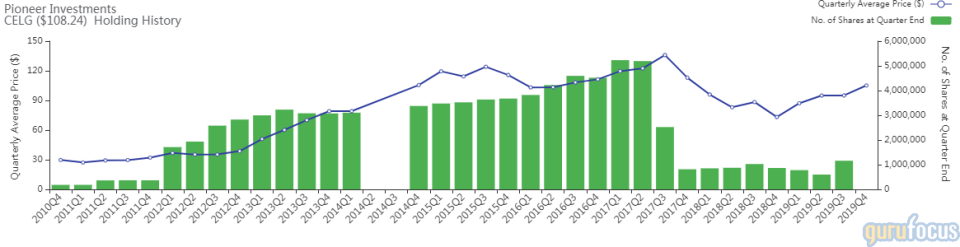

Celgene

The investment firm closed its Celgene Corp. (CELG) holding. The portfolio was impacted by -0.17%.

The biopharmaceutical firm has a market cap of $77.04 billion and an enterprise value of $85.93 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 71.15% and the return on assets of 15.65% are outperforming 91% of companies in the drug manufacturers industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.55 is below the industry median of 0.95.

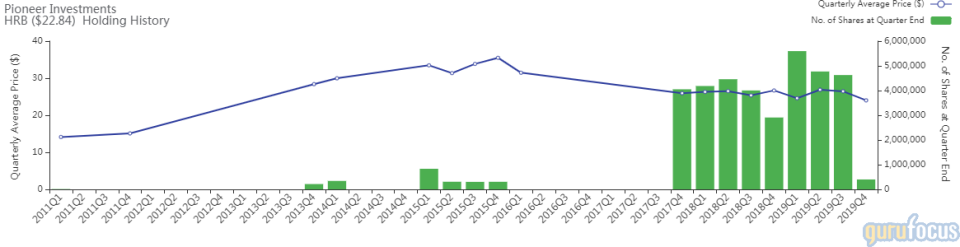

H&R Block

The guru curbed its H&R Block Inc. (HRB) position by 91.34%. The trade had an impact of -0.15% on the portfolio.

The provider of income tax return services has a market cap of $4.46 billion and an enterprise value of $6.33 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 403.79% and return on assets of 14.79% are outperforming 89% of companies in the personal services industry. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.12.

The company's largest guru shareholders include First Eagle Investment (Trades, Portfolio) with 2.87% of outstanding shares, Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 0.43% and Pioneer Investments (Trades, Portfolio) with 0.21%.

Tiffany

The investor cut its Tiffany & Co. (TIF) position by 84.6%. The portfolio was impacted by -0.12%.

The jeweler has a market cap of $16.23 billion and an enterprise value of $17.86 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 17.46% and return on assets of 9.3% are outperforming 85% of companies in the cyclical retail industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.25.

The largest guru shareholder of the company is First Eagle Investment (Trades, Portfolio) with 1.46% of outstanding shares, followed by Ron Baron (Trades, Portfolio)'s fund with 0.42% and Jeremy Grantham (Trades, Portfolio)'s GMO LLC with 0.33%.

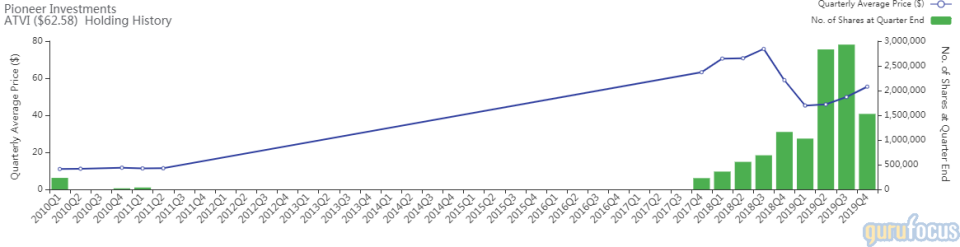

Activision Blizzard

The guru cut its Activision Blizzard Inc. (ATVI) position by 47.88%. The portfolio was impacted by -0.11%.

The videogame publisher has a market cap of $48.7 billion and an enterprise value of $44.95 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 12.54% and return on assets of 8.27% are outperforming 74% of companies in the interactive media industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 2.17 is below the industry median of 4.6.

Other guru shareholders of the company include PRIMECAP Management (Trades, Portfolio) with 1.09% of outstanding shares, Philippe Laffont (Trades, Portfolio) with 0.7% and Frank Sands (Trades, Portfolio) with 0.68%.

McDonald's

The investor reduced the McDonald's Corp. (MCD) position by 18.06%. The portfolio was impacted by -0.10%.

The fast-food restaurants franchize has a market cap of $161 billion and an enterprise value of $207 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on assets of 13.77% is outperforming 96% of companies in the restaurants industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 0.02.

Other guru shareholders of the company include Pioneer Investments (Trades, Portfolio) with 0.18% of outstanding shares, PRIMECAP Management (Trades, Portfolio) with 0.02% and Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.01%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Ron Baron Cuts CoStar, Vail Resorts

Largest Insider Trades of the Week

Jeff Ubben's Firm Sells Alliance Data Systems, Morgan Stanley

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.