Plenty of Reasons to Avoid This E-Tail Stock

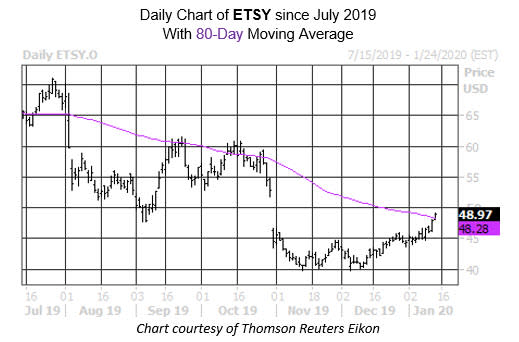

Small business retail platform Etsy Inc (NASDAQ:ETSY) has started off 2020 red-hot, already posting a nearly 10% gain. It's more of the same today, with ETSY up 1% to trade at $48.97, on track for its highest close since a late-October. However, this rally has sent the stock running head-first into a historically bearish trendline.

More specifically, Etsy stock is trading within one standard deviation of its overhead 80-day moving average. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, three similar run-ups to this trendline have occurred in the last three years. One month after these signals, ETSY was lower by an average of 9.2%, with all three returns negative.

A drop of similar magnitude would mean nearly all of the stock's 9.3% gain in 2020 would be erased next month. That 80-day trendline roughly sits just below the round $50 level too, an added layer of resistance considering it's home to the stock's post bear gap levels from a late-October earnings miss. And if that's not enough, ETSY's 14-Day Relative Strength Index (RSI) currently sits at 70, firmly in overbought territory -- indicating a pullback may be soon in the cards.

There's ample amount of optimism to be unwound. The majority of analysts rate the security a "buy" or better, with only one "sell" on the books. And among options traders there's a big appetite for calls. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), ETSY's 10-day call/put volume ratio is perched at 5.65 and ranks in the 79th percentile of its annual range. However, considering 12.6% of the equity's total available float is sold short, its possible some of these calls could be shorts hedging against any upside risk.

That being said, options can be had for a bargain right now. Etsy's Schaeffer's Volatility Index (SVI) of 38% sits in the low 7th percentile of its annual range. This means options traders are pricing in extremely low volatility expectations right now.