Pound Makes Loud Statement

The Pound has gained quickly and has kept its added value. The Bank of England and Governor Mark Carney sparked buying of the Pound last week, and it is testing important resistance entering today’s trading.

Pound Gains in Spectacular Fashion

The Pound has traded in a spectacular manner the past week. It has attained new highs and is now perched near important resistance. The British currency is trading slightly below the 1.36 juncture against the U.S Dollar.

The Bank of England lit a fire under the Pound last week with its bullish rhetoric. And today Governor Mark Carney will speak in front of the International Monetary Fund.

Knocking on the Door of Resistance

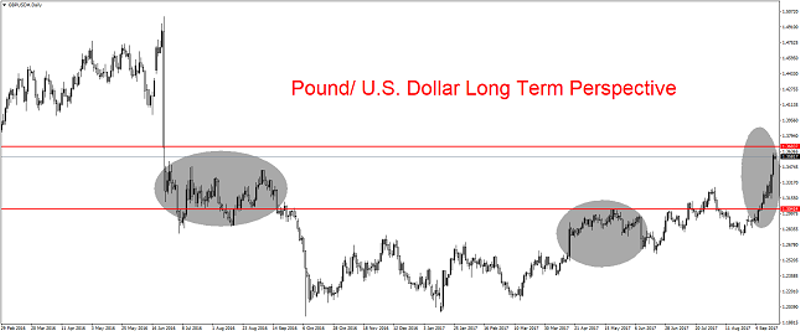

A long-term perspective of the Pound shows it has passed last year’s summer values and is now knocking on the door of values which occurred in the immediate aftermath of the Brexit vote.

The Pound will be tested at this level. With the U.S Federal Reserve looming in the shadows on Wednesday, traders may stay cautious in the short-term.

Pound has Upside Potential

The Pound could find additional buyers if sentiment remains strong that the Bank of England will raise its interest rate in the near term. A very long view of the Pound shows a window of opportunity.

Downside risks still hover for the Pound because of Brexit worries. However, traders may continue to be attracted to the British currency and look for upside potential.

In the short term, we believe the Pound may be positive. Mid-term and Long-term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire